In this article, I will explain why I incorrectly called a bust in 3D Systems Corporation (DDD) in January, and why I now consider the January-March sell-off to be a "test phase" in an ongoing reflexive boom. I will then outline reasons why the boom should continue, and why it should eventually reverse. I will also discuss the two ways it might avoid a reversal, and why I think these are unlikely outcomes. Last, I will discuss the future of the technology using the Gartner technology curve I mentioned in my previous article.

Background

I had been a bit perplexed by the moves in 3D Systems' stock recently. I wrote a long article back in December arguing that 3D Systems was in a reflexive boom-bust cycle. I outlined a model for the process, and accordingly took a long position to cash in on the boom phase.

I then called an end to the "twilight phase" on January 31st of this year, signaling the beginning of the bust. My model called for a rapid downward acceleration, which would have then led to low valuations that would merit a long investment. As such, I shorted the shares via stock and puts.

I pulled my short trade on March 26th with a substantial profit. Positive results out of competitor Stratasys (SSYS) boosted the perception of the space, and a rumour of an acquisition of 3D Systems was floating around. I could not justify staying short.

The perception seemed to be much more positive than I would expect in a reflexive bust. Normally, a bust would be followed by a phase of negative perception reinforcing the downward decline.

Not a Bust, Just a Test

Now, the reason is apparent. I was wrong that the company had entered a bust phase. Instead, I am more inclined to call the January-March sell-off a "test period".

3D Systems was able to continue the boom using the same trick it has used until now: acquisitions. With two acquisitions in the quarter, Coweb and Geomagic, the company was able to boost revenues enough t! o satisfy investors. Importantly, 3D Systems was able to boost its gross profit margin by 250 basis points. On this basis, I expect analyst upgrades of the stock to follow.

More of the Same

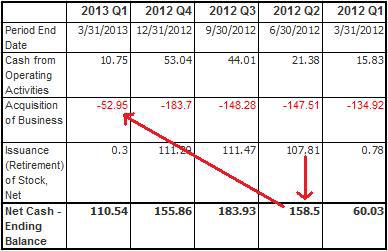

These acquisitions were paid for using cash generated by the stock issue in the second quarter of 2012:

This is the same method the company has used for the past two years - using high priced stock to fund acquisitions, which grow earnings, seeming to justify the high stock prices. The stock price then increases, allowing further acquisitions, more earnings growth, and higher stock prices. The process feeds on itself in a reflexive manner.

On May 1st, 3D Systems announced a new acquisition, RPDG, which will be accretive for the coming quarter. The acquisition will drain some of the $110 mm left on the balance sheet, so the company will use share issues to pad its cash balance, as announced on May 7.

It is interesting that management is now explicitly stating that "3D Systems intends to use the net proceeds from the offering to finance future acquisitions of other entities..." So, using the logic outlined previously, investors can expect the cycle to continue for the reasonable future.

Remember When Valuations Mattered?

Valuations are certainly stretched. My favorite indicator for a growth stock is the PEG (Price/Earnings/Growth) ratio, and I tend to use trailing growth rather than future growth figures, because earnings estimates are subject to the prevailing bias. I typically like to invest in companies with a PEG less than 1.

For the sake of argument, let's use the company's own non-GAAP figure of 43% year-over-year growth. Compared to a non-GAAP P/E of 54.42, this gives a trailing PEG ratio of 1.26. This would suggest that the company is overvalued, even by its own metrics.

I dislike the u! se of non! -GAAP figures - I believe management often uses these figures to paint a rosier picture than reality. For comparison's sake, on a GAAP basis, the earnings actually declined 4.9%, and the P/E stands at a whopping 95.

I don't wish to reignite a decades-old accounting debate, but merely to point out that even by the most optimistic metrics (the non-GAAP figures above), the company is still overvalued.

So why would I argue that 3D Systems is overvalued, but simultaneously invest in a long position?

Ignoring the Rules

At this point, the perception is driving the fundamentals - the company can continue to use its stock as currency to fund acquisitions and thus earnings growth. As long as its stock price stays above intrinsic value, it can continue to grow its intrinsic value by selling its shares.

Notice that the previously outlined model called for a decrease in earnings after the test phase:

Let's compare this to a chart of 3D Systems.

(click to enlarge)

The decline in GAAP earnings has occurred in the middle of Phase 4 of the boom, as the model dictates. I believe that growth rates were impacted by decreasing share prices in the January-March period.

If the reflexive logic holds, the share price appreciation during Phase 4 should allow the trend of acquisitions to continue stronger than ever, and earnings growth should pick up in the coming quarters on both a GAAP and non-GAAP basis.

Even if valuations do go to absurd heights, investors (and analysts) often invent interesting ways of justifying the valuations. The increasingly positive perception should boost estimates alongside the stock price. Thus, the normal rules of valuation no longer apply, and the process enters far-from-e! quilibriu! m territory.

Turning Point?

The next logical question is, if this is a boom, where is the bust? And the answer is, it may still be a while off. Now that the boom has survived a test where valuations came into question, I believe that investors will disregard valuations more than before, and the perception will become stronger than ever.

A bust would follow when expectations have gotten so far out of hand that even good results are not enough - investors will come to demand outstanding results.

It is difficult to guess what event might lead to this. This could happen if there are no more viable acquisition targets left in the space. Or if 3D Systems has acquired so many targets that the government feels compelled to step in. In addition, perhaps the "early adopter" market will become saturated, and there may be a lag phase before later adopters begin to purchase. These are merely guesses, and there are no clear signs that any of these outcomes will take place.

Nevertheless, I do argue that the ongoing increase in positive perception of the company should lead to an eventual disappointment of that optimism, however it manifests.

A Boom Without a Bust?

It is possible to have a boom without a bust. In order to prevent a bust, 3D Systems would have to exit the reflexive process at some point. Two ways it might exit the process are growing its operating cash flow enough to self-finance its growth-via-acquisition strategy, or growing organic earnings enough to justify its P/E.

For 2012, 3D Systems financed 28.3% of the cash flow necessary for its acquisitions and capital expenditures, and in the current quarter, it financed 19.4%. So it is a long way from being able to finance acquisitions through its operations alone.

As for organic earnings growth, it is difficult to break out the earnings alone, as the acquisitions affect profit margins. However, we do know that organic revenue growth is 22%, which is lower than the overall revenue growth of 31! %. So it ! follows that the organic earnings growth is lower than the combined, and this growth rate is still not capable of maintaining the high P/E ratio.

No Trough Yet

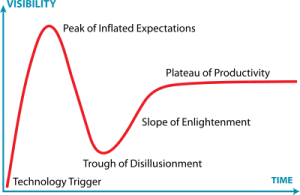

Gartner, an IT research firm, has often used the "Hype Cycle" to describe the introduction of new technologies.

3D printing as a whole did not experience a "trough of disillusionment" during the recent sell-off. Instead, it seems that news about 3D printed guns has only reignited the hype surrounding 3D printing technology. Enthusiasm and knowledge of the technology is increasing, not decreasing. Therefore, I argue we still have not hit the peak of inflated expectations. This strengthens the argument for a "Phase 4" type boom in the stock.

Summary:

3D Systems results for Q1 2013 were positively influenced by its equity-financed acquisitions.The company is continuing to use equity-financed acquisitions.3D Systems is overvalued, butHigh share prices will allow for higher growth rates in the future.The increasingly positive perception will lead to an eventual disappointment and reversal.It will be difficult for 3D Systems to avoid an eventual reversal because neither its operating cash flow or organic growth are high enough to sustain the trend.3D printing technology has not yet hit the peak of inflated expectations.Bottom Line

The long investment thesis for 3D Systems that I outlined previously is intact. The company has survived a test period, and I expect the result will be a perception that is stronger than ever, pushing both stock prices and earnings to new heights. The trend continues to be vulnerable to a bust, but there are no signs that this will happen any time soon. Thus, I am long the stock.

I expect it to be a wild ride and not for the faint of heart. The tricky part will be knowing when to jump off.

Disclosure: I am long DDD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment