Neil George, editor of By George, discusses non-bank banks and the Small Business Investment Incentive Act and suggests a way to aid your investments in the tech sector.

NANCY: Hi, my guest today is Neil George. Hi Neil, and thank you so much for dropping by.

NEIL: Nancy, it’s always a pleasure.

NANCY: That’s wonderful. Let’s talk about non-bank banks. When I think about non-bank banks, I think about the way they used to be back in the 1970’s and the 1980’s, and that’s not what the terminology means today.

NEIL: Well Nancy, there’s another phenomena in the marketplace that stems from a period of time in which the US was in a real pickle. You and I both remember the 1970’s. We both might have been little tykes back then…

NANCY: Yes, we were.

NEIL: But at least we remember our history. Inflation was really out of control. Interest rates were to the moon. Many people were having difficulty getting mortgages; a lot of people had one or two mortgages on their homes.

NANCY: And negative amortization mortgages.

NEIL: Even worse, and the idea – it wasn’t because people had bad credit, it was because banks really were kind of constrained and they knew with inflation in the double digits, if they made a mortgage loan, they were getting paid back in effectively less valuable dollars in the future, and what made it even worse and made the economy really go into that stagflation mode was that businesses couldn’t get loans, because again, banks were afraid to make loans and they were very fearful of the impact of inflation. Jimmy Carter, the president back then, and congress…

NANCY: The peanut guy.

NEIL: Yeah, the fellow from Georgia – no, and the naval officer.

NANCY: Right, a physicist.

NEIL: And a physicist, nuclear physicist, so a guy with a propeller head, but regardless of how people judge him and his presidency, one of the bit of legislations that he basically signed off on was the Small Business Investment Incentive Act of 1980, and what this bit of legislation did, it basically examined small and mid-sized businesses and what they needed. Needed to have access to capital, needed to have access to loans, and therefore, what this did was it enabled companies to be setup much like investment companies that were setup under the Investment Company Act of 1940. In other words, like funds.

NANCY: Right.

NEIL: Companies could set themselves up as a company and be able to make loans to businesses, particularly small to mid-sized firms, and they would not be taxed as a corporation, so they don’t have to pay any corporate income tax.

NANCY: Interesting.

NEIL: But, at the same time, the money that they would earn would be passed through to their investors. This provides two nice incentives. One is that the investor in these sorts of companies that would be funding it would be able to get a fairly good dividend, and back then it was pretty high, and today, there were a handful of these sorts of companies that are quite well and we’ll talk about a few in a moment, if you would like.

NANCY: Is there a percentage that they’re required to give back to the investors?

NEIL: No, there isn’t.

NANCY: Okay, so not like a REIT.

NEIL: It’s not like a REIT, but there is a general incentive for them to pass through, so the idea the investor gets a lot of cash flow back, but also, they get all the depreciation and all the other expenses passed through, so that part of their dividend is going to be shielded from current tax liability, so the benefit is you get a lot of interest in your dividend, and you’re not going to have to pay as much of your own income tax on that amount, so it’s a win-win all around. No double taxation and you actually get part of your dividend is tax shielded, so there have been a variety of companies that have used this formula to be able to operate, and one of the ones, since we’re in San Francisco, not too far away from here is Paolo Alto, which is sort of the tech mecca of the US.

NANCY: Exactly, Stanford University.

NEIL: And you have a lot of guys in hoodies in their parent’s garages that are coming up with the gizmos that you and I and the rest of the world are going to want to have or got to have, and we’ll stand in line at various stores to buy these little gizmos.

NANCY: And pay a premium for them.

NEIL: And we’ll pay premium, or it might very well be the next wiz bang thing on the internet, or who knows that it’s going to be, but tech is one of those things that Northern California is famous for. Well, there’s a firm that’s headquartered in Paolo Alto right in the thick, and there’s a – the guys running this company have really gotten to know all those guys in the hoodies in the garages, and they’ve been able to identify the guys that are going to make it and not, and so their process is they will basically come in, they will help examine the company, and a lot of them are everything from small to already established private companies in the technology world, but these companies need funding, and therefore, they will make loans to them.

NANCY: But not like VC’s where they take out part of the equity.

NEIL: No, but what they do is they do have an equity incentive, so the idea that the companies have to pay back their loans, but they also get to participate in the equity through warrants, so when the companies go public and cash out, they’ll get a piece of the action, as well as their loans repaid, and they’ve been doing this over and over. Now, the company in Paolo Alto is a company called Hercules Growth Technology Corporations, HTGC, and it’s a company that has had a fairly good track record. Some companies, like, you might remember Facebook.

NANCY: Yes, I might have heard of that.

NEIL: You might have heard of Facebook. Well, Facebook came to the market about a year ago, and one fellow with the hoodie in the garage…

NANCY: Right, Zuckerberg.

NEIL: Mr. Zuckerberg, who still likes his sweatshirts. He was able to make about $18 billion dollars out of it. Now, investors, subsequently, they’re just getting their money back kind of.

NANCY: Right, a year later.

NEIL: A year later, but Hercules got their money up front, just like Mr. Zuckerberg. Another company you might have heard of, Google.

NANCY: Yes.

NEIL: That one’s kind of famous now. Well, years ago, it wasn’t so famous, and the idea that those are two examples, and there’s a myriad of other investments that this company has helped to fund with these sort of loans. Now, one of the other great benefits, Nancy, is that, as you know, people at the Money Show are always interested in income, and income is one of those things that retirees, as well as people looking to build a portfolio really needs, and so Hercules throws off a lot of cash and the current dividend is about 8% right now.

NANCY: Very healthy.

NEIL: So the idea, if you like the idea of investing in technology and you like the idea of being able to cash in on what’s next and what’s going to be really big, but you also want to make sure you’re going to be paid and get a good dividend, Hercules is one I really think people ought to take a look at.

NANCY: Fascinating. Thank you, Neil.

NEIL: Thanks Nancy.

NANCY: And thanks for being with us on the MoneyShow.com Video Network.

Popular Posts: 5 Biotech Stocks Promising Future RewardsTurn Trash To Treasure with These Hot Small Caps3 High-Yield Income Stocks Worth Every Penny Recent Posts: 3 Travel Stocks to Buy as Vacationers Pinch Pennies Turn Trash To Treasure with These Hot Small Caps These 2 Travel Stocks Have Blue Skies Ahead View All Posts

Popular Posts: 5 Biotech Stocks Promising Future RewardsTurn Trash To Treasure with These Hot Small Caps3 High-Yield Income Stocks Worth Every Penny Recent Posts: 3 Travel Stocks to Buy as Vacationers Pinch Pennies Turn Trash To Treasure with These Hot Small Caps These 2 Travel Stocks Have Blue Skies Ahead View All Posts

Watch a hacker steal encrypted passwords

Watch a hacker steal encrypted passwords

Popular Posts: 5 Dividend Stocks You Never Saw Comin’This Year’s 5 Hottest Marijuana StocksSears Holdings (SHLD): A Ticking Time Bomb That’s Speeding Up Recent Posts: Sears Holdings – The Clock Is Ticking for SHLD Don’t Let Weakness in Small Caps Send You Overseas Best Buy Earnings – The 3 Biggest Things to Watch View All Posts

Popular Posts: 5 Dividend Stocks You Never Saw Comin’This Year’s 5 Hottest Marijuana StocksSears Holdings (SHLD): A Ticking Time Bomb That’s Speeding Up Recent Posts: Sears Holdings – The Clock Is Ticking for SHLD Don’t Let Weakness in Small Caps Send You Overseas Best Buy Earnings – The 3 Biggest Things to Watch View All Posts  Source: Flickr

Source: Flickr  Shutterstock

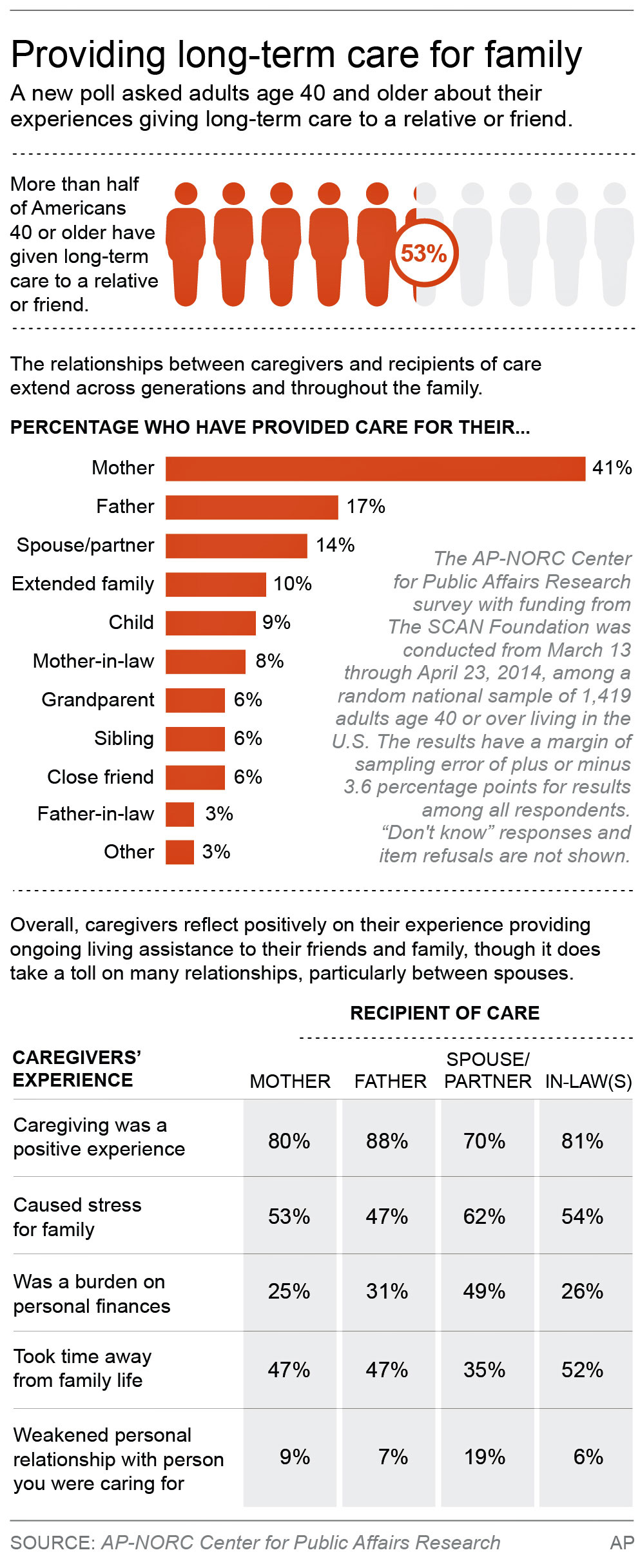

Shutterstock  Stephen Lance Dennee/AP WASHINGTON -- You promise "in sickness and in health," but a new poll shows becoming a caregiver to a frail spouse causes more stress than having to care for mom, dad or even the in-laws. Americans 40 and older say they count on their families to care for them as they age, with good reason: Half of them already have been caregivers to relatives or friends, the poll found. But neither the graying population nor the loved ones who expect to help them are doing much planning for long-term care. In fact, people are far more likely to disclose their funeral plans to friends and family than reveal their preferences for assistance with day-to-day living as they get older, according to the poll by The Associated Press-NORC Center for Public Affairs Research. And while 8 in 10 people who've been caregivers called it a positive experience, it's also incredibly difficult. "Your relationship changes. Life as you know it becomes different," said Raymond Collins, 62, of Houston, who retired early in part to spend time with his wife, Karen. Diagnosed with multiple sclerosis 15 years ago, her mobility has deteriorated enough that she now uses a wheelchair. Collins, a former business manager for an oil company, said he has felt stress, frustration and, at times, anger. "The traditional vows are through sickness and health, for richer or poorer, for better or worse, etc.," he said. "At the age of 25 and 32, you say those things and you're high on love and healthy, and life is all in front of you. The meanings of those words are pretty much lost, even when you concentrate on them." Still, he said caregiving has strengthened his marriage commitment in ways he couldn't foresee as a newlywed nearly 37 years ago. Caregiving may start with driving a loved one to the doctor or helping with household chores, but progress to hands-on care, such as bathing. Increasingly, family members are handling tasks once left to nurses, such as the care of open wounds or injections of medication. With a rapidly aging population, more families will face those responsibilities: Government figures show nearly 7 in 10 Americans will need long-term care at some point after they reach age 65. Yet just 20 percent of those surveyed think it is likely they will need such care someday. Almost twice as many, 39 percent, are deeply concerned about burdening their families. Contrary to popular belief, Medicare doesn't pay for the most common types of long-term care -- and last year, a bipartisan commission appointed by Congress couldn't agree on how to finance those services, either. But the AP-NORC Center poll found nearly 6 in 10 Americans 40 and older support some type of government-administered long-term care insurance program, a 7-point increase from last year's AP survey. The poll also found broad support for a range of policy proposals: More than three-fourths favor tax breaks to encourage saving for long-term care or for purchasing long-term care insurance. Only a third favor a requirement to purchase such coverage. Some 8 in 10 want more access to community services that help the elderly live independently. More than 70 percent support respite care programs for family caregivers and letting people take time off work or adjust their schedules to accommodate caregiving. Two-thirds want a caregiver designated on their loved one's medical charts who must be included in all discussions about care. Oklahoma this month became the first state to pass the AARP-pushed Caregiver Advice, Record and Enable -- or CARE -- Act that requires hospitals to notify a family caregiver when a loved one is being discharged and to help prepare that caregiver for nursing the patient at home.

Stephen Lance Dennee/AP WASHINGTON -- You promise "in sickness and in health," but a new poll shows becoming a caregiver to a frail spouse causes more stress than having to care for mom, dad or even the in-laws. Americans 40 and older say they count on their families to care for them as they age, with good reason: Half of them already have been caregivers to relatives or friends, the poll found. But neither the graying population nor the loved ones who expect to help them are doing much planning for long-term care. In fact, people are far more likely to disclose their funeral plans to friends and family than reveal their preferences for assistance with day-to-day living as they get older, according to the poll by The Associated Press-NORC Center for Public Affairs Research. And while 8 in 10 people who've been caregivers called it a positive experience, it's also incredibly difficult. "Your relationship changes. Life as you know it becomes different," said Raymond Collins, 62, of Houston, who retired early in part to spend time with his wife, Karen. Diagnosed with multiple sclerosis 15 years ago, her mobility has deteriorated enough that she now uses a wheelchair. Collins, a former business manager for an oil company, said he has felt stress, frustration and, at times, anger. "The traditional vows are through sickness and health, for richer or poorer, for better or worse, etc.," he said. "At the age of 25 and 32, you say those things and you're high on love and healthy, and life is all in front of you. The meanings of those words are pretty much lost, even when you concentrate on them." Still, he said caregiving has strengthened his marriage commitment in ways he couldn't foresee as a newlywed nearly 37 years ago. Caregiving may start with driving a loved one to the doctor or helping with household chores, but progress to hands-on care, such as bathing. Increasingly, family members are handling tasks once left to nurses, such as the care of open wounds or injections of medication. With a rapidly aging population, more families will face those responsibilities: Government figures show nearly 7 in 10 Americans will need long-term care at some point after they reach age 65. Yet just 20 percent of those surveyed think it is likely they will need such care someday. Almost twice as many, 39 percent, are deeply concerned about burdening their families. Contrary to popular belief, Medicare doesn't pay for the most common types of long-term care -- and last year, a bipartisan commission appointed by Congress couldn't agree on how to finance those services, either. But the AP-NORC Center poll found nearly 6 in 10 Americans 40 and older support some type of government-administered long-term care insurance program, a 7-point increase from last year's AP survey. The poll also found broad support for a range of policy proposals: More than three-fourths favor tax breaks to encourage saving for long-term care or for purchasing long-term care insurance. Only a third favor a requirement to purchase such coverage. Some 8 in 10 want more access to community services that help the elderly live independently. More than 70 percent support respite care programs for family caregivers and letting people take time off work or adjust their schedules to accommodate caregiving. Two-thirds want a caregiver designated on their loved one's medical charts who must be included in all discussions about care. Oklahoma this month became the first state to pass the AARP-pushed Caregiver Advice, Record and Enable -- or CARE -- Act that requires hospitals to notify a family caregiver when a loved one is being discharged and to help prepare that caregiver for nursing the patient at home.  Just 30 percent in this age group who say they'll likely care for a loved one in the next five years feel prepared to do so. Women tend to live longer than men and consequently most family caregivers, 41 percent, assist a mother. Seventeen percent have cared for a father, and 14 percent have cared for a spouse or partner, the poll found. The tug on the sandwich generation -- middle-aged people caring for both children and older parents, often while holding down a job -- has been well-documented, and the new poll found half of all caregivers report the experience caused stress in the family. But spouses were most likely to report that stress and to say caregiving weakened their relationship with their partner and burdened their finances. Spouses are more likely to handle complex care tasks, on duty 24-7 with less help from family and friends, said Lynn Feinberg, a caregiving specialist at AARP. Physically, that can be harder because spouse caregivers tend to be older: In the AP-NORC poll, the average age of spouse caregivers was 67, compared with 58 for people who've cared for a parent. Virginia Brumley, 79, of Richmond, Indiana, cared for her husband, Jim, for nearly five years while he suffered dementia and Parkinson's syndrome, care that eventually required feeding, dressing and diapering him. "I think I loved him more after I started caring for him. I saw what a wonderful person he was: his [positive] attitude, his kindness, his acceptance of things," she said. But he lived his last 11 months in a nursing home because "I couldn't handle him anymore," Brumley said. "He was too big for me. He was as helpless as a baby." The AP-NORC Center survey was conducted by telephone March 13 to April 23 among a random national sample of 1,419 adults age 40 or older, with funding from the SCAN Foundation. Results for the full survey have a margin of sampling error of plus or minus 3.6 percentage points. -.

Just 30 percent in this age group who say they'll likely care for a loved one in the next five years feel prepared to do so. Women tend to live longer than men and consequently most family caregivers, 41 percent, assist a mother. Seventeen percent have cared for a father, and 14 percent have cared for a spouse or partner, the poll found. The tug on the sandwich generation -- middle-aged people caring for both children and older parents, often while holding down a job -- has been well-documented, and the new poll found half of all caregivers report the experience caused stress in the family. But spouses were most likely to report that stress and to say caregiving weakened their relationship with their partner and burdened their finances. Spouses are more likely to handle complex care tasks, on duty 24-7 with less help from family and friends, said Lynn Feinberg, a caregiving specialist at AARP. Physically, that can be harder because spouse caregivers tend to be older: In the AP-NORC poll, the average age of spouse caregivers was 67, compared with 58 for people who've cared for a parent. Virginia Brumley, 79, of Richmond, Indiana, cared for her husband, Jim, for nearly five years while he suffered dementia and Parkinson's syndrome, care that eventually required feeding, dressing and diapering him. "I think I loved him more after I started caring for him. I saw what a wonderful person he was: his [positive] attitude, his kindness, his acceptance of things," she said. But he lived his last 11 months in a nursing home because "I couldn't handle him anymore," Brumley said. "He was too big for me. He was as helpless as a baby." The AP-NORC Center survey was conducted by telephone March 13 to April 23 among a random national sample of 1,419 adults age 40 or older, with funding from the SCAN Foundation. Results for the full survey have a margin of sampling error of plus or minus 3.6 percentage points. -.

Related BZSUM Market Wrap for May 19: Markets Finish Higher On M&A Monday Mid-Afternoon Market Update: Markets Drift Higher Amid A Flurry Of Weekend M&A Activity

Related BZSUM Market Wrap for May 19: Markets Finish Higher On M&A Monday Mid-Afternoon Market Update: Markets Drift Higher Amid A Flurry Of Weekend M&A Activity