BALTIMORE (Stockpickr) -- Bring on the earnings. Maybe they'll be enough to distract investors from the shenanigans taking place on Capitol Hill.

>>5 Stocks Ready to Break Out

Yes, it's earnings season once again, that time each quarter when companies reveal their performance numbers to Wall Street. Earnings are one of only four times each year when fundamental investors get a snapshot of how their companies are doing, so it's not a huge surprise that earnings season comes with the potential to really impact share prices.

With a whole new debt-ceiling debacle threatening to derail the stock rally of 2013, the buying impact from good fundamental growth would be pretty welcome right now.

But to take full advantage of the next round of earnings releases, we're not just jumping in ahead of the next earnings release. Instead, we're turning to a new set of Rocket Stock names.

>>Why I'm Sticking By Dow 55,000

For the uninitiated, "Rocket Stocks" are our list of companies with short-term gain catalysts and longer-term growth potential. To find them, I run a weekly quantitative screen that seeks out stocks with a combination of analyst upgrades and positive earnings surprises to identify rising analyst expectations, a bullish signal for stocks in any market. After all, where analysts' expectations are increasing, institutional cash often follows. In the last 218 weeks, our weekly list of five plays has outperformed the S&P 500 by 89.5%.

Without further ado, here's a look at this week's Rocket Stocks.

Johnson & Johnson

Johnson & Johnson (JNJ) is having a stellar year in 2013. Shares of the healthcare giant have rallied more than 27% since the start of the year, around double what the venerable S&P 500 has managed to accomplish over the same time period. Johnson's set to announce its earnings numbers tomorrow.

>>5 Big Stocks to Trade for Big Gains

Johnson & Johnson is the prototypical blue-chip stock. The $252 billion firm pays out just shy of a 3% dividend yield, and it's got a model that works well in good times and in bad ones. The business includes everything from consumer products such as Band-Aid brand bandages to pharmaceuticals and medical devices.

While pharma makes up a large chunk of the firm's net income, the consumer and medical device segments offer investors diversification that few big pharma names can match -- especially as patent drop-offs plague valuations in the industry.

JNJ is a big beneficiary of changing demographics. As the baby boomer population in the developed world gets older, medical costs are expected to inflate in kind, and that's a good thing for pharma-driven firms such as Johnson & Johnson. Elsewhere, burgeoning younger populations in emerging markets are there to pick up the demand for its consumer products.

Boeing

Aerospace standard-bearer Boeing (BA) is one firm that stands to lose a lot if the government stops paying its bills. Boeing may be best-known to the public for its airliners, but it actually earns around half of its revenues as a defense contractor. Luckily for Boeing -- and the rest of the financial system -- any saber-rattling from Congress is still likely to have only temporary consequences.

>>5 Stocks Hedge Funds Love This Fall

Back on the commercial aviation side, Boeing's 787 Dreamliner hasn't gone off quite without a hitch, but the important thing is that it has gone off. The airliner stands to dramatically improve profitability at carriers who use the strikingly more fuel-efficient model, and that's helping to keep orders flowing in.

Better, recent strong performance in airline stocks means that Boeing's customers have access to cash on even more attractive terms. A re-engined version of the extremely popular 737 airliner should be another key driver of sales for Boeing -- one that comes with lower costs for both BA and the customers who buy the 737s.

One of Boeing's most important assets is the one you won't find on its balance sheet: a $410 billion backlog. That backlog should provide a lot of downside protection for BA's sales in the foreseeable future. Keep an eye on earnings later this month; they're scheduled for Oct. 23.

EOG Resources

EOG Resources (EOG) has been another high-flier in 2013. Shares of the oil and gas exploration and production firm have climbed more than 48% higher since the calendar flipped over to January. A lot of that performance has come more recently, thanks to overall strength in the energy sector, so with relative strength scoring well right now, it makes sense to take a closer look at EOG.

>>5 Stocks Insiders Are Scooping Up

The E&P business is attractive right now -- attractive enough, anyway, for a few high-profile integrated firms to start shedding their low-margin downstream assets in recent years. EOG doesn't have to do that, though. It's already a pure-play E&P. EOG owns proven reserves of 1.8 billion barrels of oil equivalent spread across North America, with a smaller presence in Trinidad and Tobago, the UK, Argentina and China. EOG is an expert in unconventional drilling situations, which means that the firm is able to unlock profits that would typically go to specialist oil field servicers -- or be left in the ground. As a result, the firm can buy up cheap projects that are no longer profitable for rivals, and wring cash out of them.

Because of EOG's size, it's able to let less-lucrative sites sit dormant until oil prices pick back up. That production flexibility means that the firm is able to consistently generate net profit margins in the double digits. We'll get our next glimpse at EOG's numbers on Nov. 7.

Kimberly-Clark

Paper maker Kimberly-Clark (KMB) owns a handful of hugely popular health and hygiene brands that include Kleenex, Scott towels, and Huggies. That positioning means that it doesn't get much more defensive than KMB; this stock is the king of consumer staples.

>>How to Avoid Big Losses During the Government Shutdown

Kimberly-Clark's brands lead the pack in the segments they compete in -- and four of them generate more than $1 billion in annual sales. While competition from store brands continues to be a challenge in a sluggishly rebounding economy, consumers are far less likely to trade down on products like diapers. For that reason, the firm enjoys an economic moat that most of its rivals lack.

Today, around half of KMB's sales come from outside North America. And as that sales mix continues to move outside the continent, investors should benefit. High birth rates in emerging markets could provide considerable growth for KMB in the years ahead, especially as growing middle class populations have the cash to pay for luxuries like disposable diapers.

Like any good defensive name, KMB currently pays out a dividend of 3.3% right now.

Estee Lauder

Cosmetics and fragrance manufacturer Estee Lauder (EL) is gearing up to report earnings of its own; the firm releases its fiscal first-quarter numbers on Oct. 31. And if those results are anything like investors have become accustomed to, there's more upside in store for this beauty company.

>>5 Stocks Under $10 Set to Soar

Estee Lauder owns a brand portfolio that includes popular names such as Clinique in addition to mall staples M-A-C and Origins. That's enough makeup power to give EL a 25% share of the world's high-end cosmetics market, a segment that's continuing to hold up quite well in the current retail market.

The growth story for Estee isn't unlike the story at Kimberly-Clark or Johnson & Johnson: It all comes down to pent-up demand among a whole new group of middle class consumers in emerging markets. Right now, the firm gets around half of its revenues from overseas, and developing countries making up a bigger chunk each year.

With rising analyst sentiment in shares of EL this week, we're betting on shares.

To see all of this week's Rocket Stocks in action, check out the Rocket Stocks portfolio at Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>5 Stocks Rising on Unusual Volume

>>SolarCity Set to Soar Even Higher

>>4 Stocks Under $10 Making Big Moves

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.

Follow Jonas on Twitter @JonasElmerraji

REUTERS

REUTERS  Elwyn (right), however, sees things differently. “Despite the extremes of market highs and lows, what’s consistent is that many competitors – at the wirehouse and regional firms – continue to create pain points for their advisors,” he said.

Elwyn (right), however, sees things differently. “Despite the extremes of market highs and lows, what’s consistent is that many competitors – at the wirehouse and regional firms – continue to create pain points for their advisors,” he said. Fall is always a welcome change of pace for most people after a long, hot summer. It brings relief not only from the temperatures, but at the gasoline pump as well. Pundits frequently notice this phenomenon during election years, and assume that vested interests are trying to manipulate prices to win elections. But there is a more straightforward explanation to what’s going on, and it can benefit consumers, LNG producers, and sometimes refiners.

Fall is always a welcome change of pace for most people after a long, hot summer. It brings relief not only from the temperatures, but at the gasoline pump as well. Pundits frequently notice this phenomenon during election years, and assume that vested interests are trying to manipulate prices to win elections. But there is a more straightforward explanation to what’s going on, and it can benefit consumers, LNG producers, and sometimes refiners. Related ABX Markets Debut Week On Negative Note; S&P 500 Falls Through Key Level Benzinga's Top Upgrades M&A Activity Boosts U.S. Stock Futures (Fox Business)

Related ABX Markets Debut Week On Negative Note; S&P 500 Falls Through Key Level Benzinga's Top Upgrades M&A Activity Boosts U.S. Stock Futures (Fox Business)

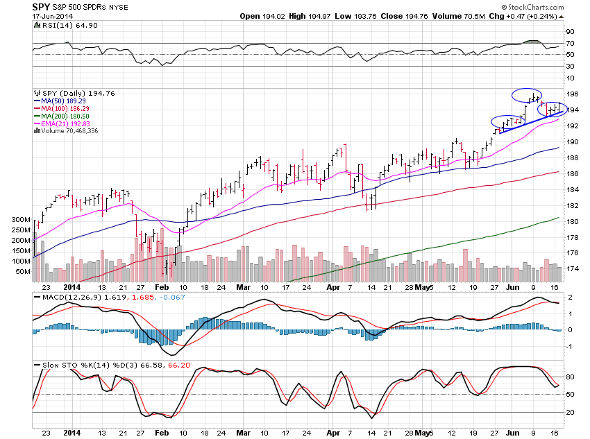

SPY still has a small head and shoulders pattern here that if it is to work should bring this exchange-traded fund back to 190. That said, a move and daily close above 195 should annul the pattern.The way stocks are behaving we may not see this head and shoulders pattern play out. We are in a very strong market at the moment.

SPY still has a small head and shoulders pattern here that if it is to work should bring this exchange-traded fund back to 190. That said, a move and daily close above 195 should annul the pattern.The way stocks are behaving we may not see this head and shoulders pattern play out. We are in a very strong market at the moment.

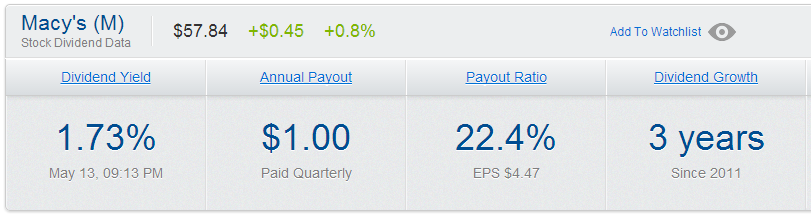

) reported first quarter earnings that came in above analysts’ estimates. The company also announced a 25% dividend increase.

) reported first quarter earnings that came in above analysts’ estimates. The company also announced a 25% dividend increase.