The Gold Report: What do the Fed's recent statements about the timing of possible future interest rate hikes mean for the price of gold?

Jeff Wright: The Fed is almost finished buying mortgage-backed securities in an attempt to stabilize the market. We anticipate it will gradually increase interest rates by Q2/15. The most recent Federal Reserve minutes showed that there is no real drive to accelerate that pace. We will probably see low interest rates for the foreseeable future. Anything more is just not feasible, given the level of U.S. governmental debt. We would have to dedicate as much as three-quarters of the U.S. budget to interest payments if rates were to go back to normal historic levels.

"Pretium Resource Inc. has done a very good job managing the Brucejack project."

It has not been pretty for gold over the last few months. The recent selloff in gold was predicated on a stronger dollar more than anything else. Anticipation of a rise in interest rates has also played into the strengthening dollar. And new quantitative easing in Europe and Japan just add to the relative strength of the dollar over the euro and the yen.

TGR: Some experts we interviewed told us that the extreme negative sentiment toward gold is a sign that we are at a bottom and getting ready for a turnaround. Even former Federal Reserve Chair Alan Greenspan has made bullish comments about gold. Are you seeing indicators that gold is ready to turn again?

JW: Picking bottoms or tops is not for the faint of heart. Even the most researched call can easily be wrong the very next day. It is a function of a global price commodity that trades 24/7 that one headline can change the price dramatically. While gold has supply and demand fundamentals, it has emotional characteristics as well. It's not as rational or as forecastable as other investments. That is why I look for sustained trends. One of those is the demand for physical gold from China, which is down since 2012. I am not confident that Chinese buyers will come in this time to keep gold above $1,200 an ounce ($1,200/oz). And we will have to see how the traditional Indian wedding season plays out.

I think Greenspan's recent comments in an article in Foreign Affairs about the possibility that China is buying gold in an attempt to make its currency convertible to gold are a shot across the U.S. bow. We need to get our financial house in order because the level of deficits that we've had for the past 10 years is not sustainable. That is probably not the greatest news for the U.S. economy, but it could be a good sign for gold long term.

TGR: In the short term, if the gold price is range bound, which is what you said in your last interview, how are junior miners adjusting their operations to be successful?

JW: Companies are attempting to reign in labor and energy costs. They are more selective of what material they're putting through the mill and what material they're stockpiling for higher gold prices down the road. Some projects are being selectively mined for higher-grade material. The survivors will be the companies that can extract savings from operations while limiting discretionary exploration. That is going to come back around to impact the industry in a couple of years when there is a dearth of exploration for organic growth and acquisition potential. But for now, there is just not an appetite for true exploration. Even positive news is being met with a shrug.

TGR: Would you say that the funded developers are in the best position because they can move forward with the hope that by the time they go into production the gold price will be higher?

JW: They certainly are in a better place than an unfunded developer, because the equity markets just are not there right now for large capital requirements. A number of companies are slow-walking projects into a production decision to avoid mining a project at close to a breakeven point.

We are seeing merger and acquisition activity around the edges, but not a full scale movement toward some of the juniors being acquired and going away, at least not yet.

A bigger trend on the horizon is broader industry consolidation. Some large companies have been selling assets. One example is Barrick Gold Corp. (ABX:TSX; ABX:NYSE) and Goldcorp Inc. (G:TSX; GG:NYSE) selling the Marigold project to Silver Standard Resources Inc. (SSO:TSX; SSRI:NASDAQ). That is a good project, but it didn't make sense for the two larger companies.

TGR: Let's talk about some of the companies that you have under coverage.

JW: One of the companies I cover is Pretium Resources Inc. (PVG:TSX; PVG:NYSE)(Rated: Buy). I conducted a site visit in August of its Brucejack project in northern British Columbia. The company has done a very good job managing the project, increasing the size and the quality of the reserve. The grades there are phenomenal. It is a near-surface, underground mine, so the development is not that expensive. The company has to raise approximately $700 million ($700M), but the updated feasibility study shows the project is still quite profitable at $1,200/oz gold.

TGR: How will Pretium raise the capital for mine construction?

JW: It will probably be a mixture of debt and equity, but with the scale tilted more toward debt. I don't see management wanting to overly dilute the project. I think that's a really good example of management not trying to unnecessarily accelerate development. Pretium is letting the project play out. It's looking to grow a true mining company with a good resource base and a reserve that will be mined with outstanding economics for 15–20 years. $700M is a large number to fund, but it makes sense based on the grade and the tonnage that the project can sustain.

TGR: Is permitting going to be a challenge?

JW: The project is on track to get its permits by the middle of 2015. Brucejack doesn't have the environmental concerns of some other projects. It's in a fairly isolated place with no major water or wildlife issues, and management has a good relationship with the First Nations in that area of British Columbia. It's a mine that makes sense.

TGR: What is another company that you think is doing a good job?

JW: One that the market has not caught on to yet is Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE)(Rated Buy). It has the Railroad-Pinion project in north-central Nevada on the Carlin Trend. The company has successfully consolidated the project and conducted a confirmatory round of drilling. It recently released a maiden NI-43-101-complaint resource calculation that shows about 1.4 million ounces gold in the Indicated and Inferred categories, as well as a little bit of silver. It has fairly shallow mineralization and could be an open-pit, heap-leach mine in the 2016–2017 timeframe with little technical risk. It is in the right neighborhood, with infrastructure and a ready-made workforce in close proximity. The permitting is straightforward. The next round of drilling is underway as management looks for extensions at depth and along strike. This company is moving the ball forward with a relatively low capital budget on the exploration and development side. It is still a couple of years out, but it is certainly interesting.

TGR: You initiated coverage with a 12-month target of $1.75/share. What do you think is going to take it there from its current price of $0.73/share?

JW: I think the market doesn't have a full awareness of the fundamental characteristics of the deposit and the timeline to production. Gold Standard released its resource estimate right as people were rotating out of gold, and that was just bad timing.

TGR: How about one more company?

JW: I visited Richmont Mines Inc.'s (RIC:TSX; RIC:NYSE.MKT)(Rated Buy) Island gold project in Ontario in April. This producer just raised its annual guidance from 75,000–85,000 ounces (75–85 Koz) to 85–90 Koz by mining deeper into a higher-grade area. The company is building out additional underground infrastructure to access the higher-grade stopes. A new CEO, Elaine Ellingham, stepped in on an interim basis and she has really jump-started the process. The focus is on increasing production and profitability while making investments on the exploration side.

Richmont stock was close to $1/share earlier in the year and now it is over $2/share. The past month has not been exactly kind, but then the stock may have gotten a little bit ahead of itself. It is starting to look as if it will have a sustained recovery based on earnings announced in August and this more aggressive approach at Island Gold. This is a company that has made the hard choices. It has invested in its project and now just needs to effectively operate and deliver.

TGR: Any words of wisdom you might have for investors looking to survive, maybe even thrive, in the natural resources space today?

JW: When evaluating a project, you have to ask some key questions. First, is the project a sustainable mine over the long term, even with low commodity prices? I would shy away from companies with projects that require higher gold prices to make sense.

The second element is whether the mine is permitable and in a good jurisdiction. A no to either of those questions is a nonstarter for me.

Finally, has the management team proven it can run an effective mining company? You have to have competent management that can achieve their production goals and meet operational guidance.

TGR: Thank you for that advice.

Jeff Wright of H.C. Wainwright & Co. has more than 15 years of capital markets experience. Previously with Global Hunter Securities, Wright has also worked as a managing director and head of the natural-resource practice at Shoreline Pacific LLC. Prior to that he was vice president at Montgomery & Co. and was a leader on the team that launched a capital markets business in a historically mergers and acquisitions-focused investment bank. Wright was formerly a vice president at Robertson Stephens in the equity financial products group. Wright received his Master of Business Administration from the University of Southern California and his Bachelor of Arts degree in political science from North Carolina State University.

Read what other experts are saying about:

Pretium Resources Inc.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) Jeff Wright: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned: Pretium Resources Inc., Richmont Mines Inc. and Gold Standard Ventures Corp. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over what companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

3) The following companies mentioned in the interview are sponsors of Streetwise Reports: Pretium Resources Inc., Richmont Mines Inc. and Gold Standard Ventures Corp. Goldcorp is not affiliated with Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert can speak independently about the sector.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

( Companies Mentioned: GSV:TSX.V; GSV:NYSE,

PVG:TSX; PVG:NYSE,

RIC:TSX; RIC:NYSE.MKT,

)

The following article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Posted-In: Commodities Markets

Originally posted here...

Related Articles Transocean Offers Fleet Status Report: Total Value of New Contracts ~$610M Las Vegas Sands Reports Q3 Results In-Line With Expectations Markets Rebound After Getting Crushed Intraday, Still Close Lower What Finance Experts Are Saying About Mortgages Today Barclays: Johnson & Johnson's Q3 Could Be 'High Water Mark' Oppenheimer Top ideas Monthly: Financial Institutions Around the Web, We're Loving...

Joe Buglewicz for The Wall Street Journal

Joe Buglewicz for The Wall Street Journal

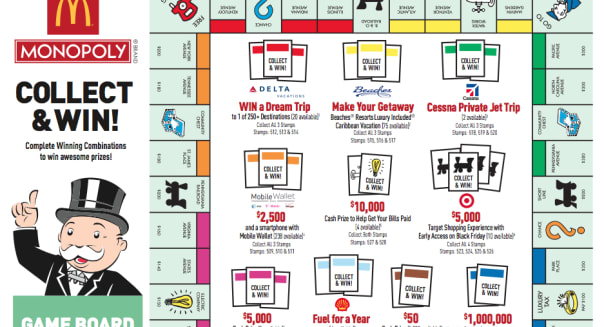

www.mcdonalds.com Monopoly is back at McDonald's (MCD). The world's largest burger chain has revived its annual promotion, and Big Mac lovers have until Oct. 27 to collect game stamps themed to Hasbro's (HAS) Monopoly board game. It's a big deal, and McDonald's can use the extra attention. The fast-food chain has posted negative year-over-year comparable-restaurant sales in nine of the past 10 months. Let's look at some of things that you might not know about the four-week promotion. 1. You Don't Really Win $1 Million in Real Dollars The top prize is once again a $1 million prize if a customer nabs the Park Place and Boardwalk pieces. However, the lucky winner had better not go on a $1 million shopping spree. Tax considerations aside, the winning prize is actually an annuity -- $50,000 every year for the next 20 years. That does add up to $1 million, but you have to factor in inflation. The actual value of the $1 million prize in today's dollars is closer to half that sum. 2. The Odds Are Very Long for the Grand Prize The odds of finding Park Place are 1 in 11, but the odds of finding Boardwalk are 1 in 651 million. So your chances of getting them both to win the $1 million grand prize are about 1 in 3.5 billion. 3. Yes, There Was a Cheating Scandal Big prizes draw big attention, but they also bring out the worst in scammers. In 1995, a head of security for the marketing company running the promotion started to steal the top prizes. He would then pass them along to associates in exchange for a piece of the action. By the time it was uncovered a few years later, this multi-state crime ring had claimed $20 million in prizes. Eight people were ultimately arrested. Realizing that it had a public relations nightmare on its hands, McDonald's acted quickly. It announced that it would be dishing out an additional $10 million in prizes in the next installment of the Monopoly promotion. That seems to have done the trick. Consumers flocked back to the Golden Arches during the promotion, and McDonald's has yet to be connected to another internal security breach. 4. McDonald's Doesn't Host the Promotion at the Same Time Every Year In a world of seasonal rollouts -- from pumpkin spice lattes in October to eggnog shakes in December -- McDonald's favors late September to launch this annual promotion, which had its debut in 1987. It ran that way in three of the past four years, but last year, facing weak store-level trends, McDonald's rolled out the game in mid-July to give sales a much-needed lift. This could be a good thing for McDonald's investors. After all, when it does put out same-restaurant sales for October come early November, it will be comparing the Monopoly-backed traffic boost of this month pitted against the Monopoly-less October of 2013. 5. You Have a Pretty Good Chance to Win -- By Design Prizes like the $1 million annuity and a Cessna jet vacation may draw the attention, but your odds of walking away a winner are a spiffy 1 in 4. Most are instant-win prizes, and that usually means free food. It's a smart move. Folks don't get discouraged because repeat customers can feel confident that they will eventually win , and since they have to come back to redeem those free drinks, sandwichs, or fries, that virtually ensures another visit during which the patron will likely spend money in addition to claiming their prize item. Everyone's a winner, including McDonald's. More from Rick Aristotle Munarriz

www.mcdonalds.com Monopoly is back at McDonald's (MCD). The world's largest burger chain has revived its annual promotion, and Big Mac lovers have until Oct. 27 to collect game stamps themed to Hasbro's (HAS) Monopoly board game. It's a big deal, and McDonald's can use the extra attention. The fast-food chain has posted negative year-over-year comparable-restaurant sales in nine of the past 10 months. Let's look at some of things that you might not know about the four-week promotion. 1. You Don't Really Win $1 Million in Real Dollars The top prize is once again a $1 million prize if a customer nabs the Park Place and Boardwalk pieces. However, the lucky winner had better not go on a $1 million shopping spree. Tax considerations aside, the winning prize is actually an annuity -- $50,000 every year for the next 20 years. That does add up to $1 million, but you have to factor in inflation. The actual value of the $1 million prize in today's dollars is closer to half that sum. 2. The Odds Are Very Long for the Grand Prize The odds of finding Park Place are 1 in 11, but the odds of finding Boardwalk are 1 in 651 million. So your chances of getting them both to win the $1 million grand prize are about 1 in 3.5 billion. 3. Yes, There Was a Cheating Scandal Big prizes draw big attention, but they also bring out the worst in scammers. In 1995, a head of security for the marketing company running the promotion started to steal the top prizes. He would then pass them along to associates in exchange for a piece of the action. By the time it was uncovered a few years later, this multi-state crime ring had claimed $20 million in prizes. Eight people were ultimately arrested. Realizing that it had a public relations nightmare on its hands, McDonald's acted quickly. It announced that it would be dishing out an additional $10 million in prizes in the next installment of the Monopoly promotion. That seems to have done the trick. Consumers flocked back to the Golden Arches during the promotion, and McDonald's has yet to be connected to another internal security breach. 4. McDonald's Doesn't Host the Promotion at the Same Time Every Year In a world of seasonal rollouts -- from pumpkin spice lattes in October to eggnog shakes in December -- McDonald's favors late September to launch this annual promotion, which had its debut in 1987. It ran that way in three of the past four years, but last year, facing weak store-level trends, McDonald's rolled out the game in mid-July to give sales a much-needed lift. This could be a good thing for McDonald's investors. After all, when it does put out same-restaurant sales for October come early November, it will be comparing the Monopoly-backed traffic boost of this month pitted against the Monopoly-less October of 2013. 5. You Have a Pretty Good Chance to Win -- By Design Prizes like the $1 million annuity and a Cessna jet vacation may draw the attention, but your odds of walking away a winner are a spiffy 1 in 4. Most are instant-win prizes, and that usually means free food. It's a smart move. Folks don't get discouraged because repeat customers can feel confident that they will eventually win , and since they have to come back to redeem those free drinks, sandwichs, or fries, that virtually ensures another visit during which the patron will likely spend money in addition to claiming their prize item. Everyone's a winner, including McDonald's. More from Rick Aristotle Munarriz