BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Stocks Ready to Pop on Bullish Earnings

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Mega-Cap Stocks to Trade for Gains

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

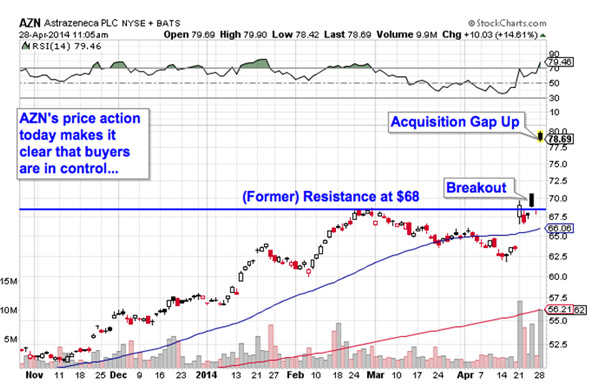

AstraZeneca

Nearest Resistance: N/A

Nearest Support: $68

Catalyst: Pfizer Acquisition Bid

First up is AstraZeneca plc (AZN), the $100 billion drugmaker. AZN is up more than 14% this afternoon after Pfizer (PFE) confirmed that it was still pursuing an acquisition offer following its failed bid in January. At the start of the year, AstraZeneca rejected an acquisition offer that valued the firm at approximately $100 billion, and shares have rallied on hopes that a sweeter deal will come along. That makes for the second straight week of major pharmaceutical M&A activity moving the markets.

From a technical standpoint, AZN started looking bullish late last week thanks to a breakout through $68 resistance. Now that's a support level for shares. Today's price action is a strong indication that buyers are in control here, but the event risk of a lackluster acquisition offer does put somewhat of a damper on AZN's upside from here. More upside still looks probable in AZN, but it's going to be limited by the size of an acquisition price that PFE can swallow.

Pfizer

Nearest Resistance: $33

Nearest Support: $30

Catalyst: AstraZeneca Acquisition Bid

Not surprisingly, Pfizer (PFE) is getting its fair share of trading volume on news of the acquisition attempt. PFE is up almost 4% this afternoon, gapping higher as investors anticipate the potential for big combination advantages between the two major pharma firms.

But zoom out a little longer-term, and Pfizer's price action starts to look a little less auspicious. In fact, after rallying hard since the middle of last summer, this stock is starting to show traders signs of a head and shoulders top. The neckline at $30 is the breakdown level for Pfizer; if shares fail to catch a bid at that level in May, then this name becomes a sell.

Charter Communications

Nearest Resistance: $140

Nearest Support: $120

Catalyst: Q1 Earnings

Charter Communications (CHTR) is up more than 7% this afternoon, following the firm's first quarter earnings call. The firm lost 35 cents per share for the quarter, widely missing analysts' 10-cent profit expectations. But shares are rallying despite the miss on an earlier announcement that Comcast (CMCSA) will be selling Charter nearly 4 million subscribers. That big change to Charter's business is the context that investors are using to judge this quarter's earnings call.

Technically, Charter has been consolidating sideways in a wide-ranging channel between $120 and $140. So while today's move higher is pressing CHTR against the top of that channel, it still hasn't exited. A breakout above $140 is a buy signal for Charter -- it's a level that buyers haven't been able to sustain beyond intraday.

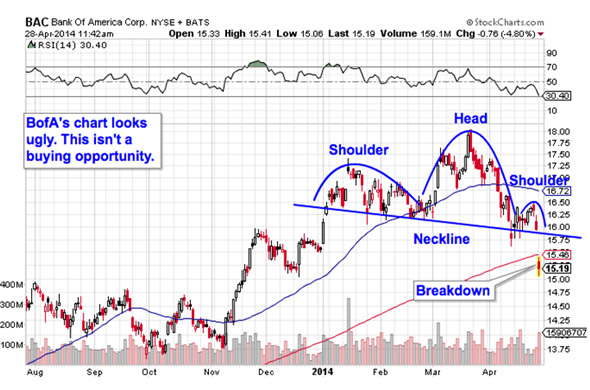

Bank of America

Nearest Resistance: $15.75

Nearest Support: $13.75

Catalyst: Accounting Error

Oops -- Bank of America (BAC) announced that it made an incorrect adjustment on some investments that it acquired long with Merrill Lynch in the wake of the Great Recession. Because of the error, the Federal Reserve is ordering BofA to suspend share buybacks and planned dividend hikes until it resubmits a fresh capital analysis for review. Investors are selling off Bank of America this afternoon, pushing shares down around 5% as I write.

That selling isn't hugely surprising. BofA has been forming a textbook head and shoulders top for the last four months, a bearish reversal pattern that triggered on today's slip through $15.75. Put simply, buyers were exhausted in BAC, and sellers are in control now.

Today's drop isn't a buying opportunity -- it's a warning shot. BofA has more meaningful support down at $13.75.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>3 Stocks Spiking on Unusual Volume

>>5 Toxic Stocks to Watch Out For

>>5 Stocks Poised for Breakouts

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment