Getty Images

Getty Images Often, the best way to avoid a rip-off is to know what others are paying for things. What did the guy sitting next to me on the plane pay for his ticket? How much did the neighbor pay for his kid's wedding? That emergency dental procedure? The water pump replacement on her late-model foreign car? Retailers use big data to maximize revenue -- that is, to take as much of your money as they can. Why shouldn't you have the same power? Increasingly, websites and apps are giving consumers access to incredibly detailed aggregate price information, holding out the promise that the scales of bargaining power might tip back their way. There are now hundreds of online tools -- most of them unbiased and data driven -- that tell consumers the prices others have paid for everything from flowers to bathroom renovations. Enter a ZIP code, select a few criteria and faster than a shopkeeper can say, "High profit margin," you can say, "Not so fast!" The price calculators -- many are called "cost estimators" -- are fun to play with, but they pack a real punch. None of these tools will prevent a bait-and-switch estimate, or keep you from getting nickel-and-dimed. But they do something just as important: They give you a reference point (what economists call an anchor) so you always know you are in the right ballpark, if not sitting in the right seat, when paying for something. I'll divide the tools into three categories: Regret tools, bargaining tools and anxiety tools. Let me explain. Regret Tools Data are always backward looking, and as we all know, the past is no guarantee of future performance. So it is with prices others paid. This is most obvious in airline tickets, where knowing your friend got a good deal on a flight to Ireland last week is almost useless as a predictor of your price, other than the near certainty that you will pay more. Still, longer trends offer some insights, and that's what I love about FlightAware's beta product, "Insight for Airlines." FlightAware is known for giving passengers and their loved ones up-to-the-moment geographic and speed data on planes in the air. But click around, and you'll find the Insight product, which tells users the median price paid for tickets on that route, by airline, during a 12-month period. It also includes the maximum and minimum prices for that route. If you're on the plane, you'll either feel smart or stupid, based on what you paid. Flightaware's director of software development, Jeffrey Lawson, notes that the data tool comes with a long list of qualifiers. For starters, the data, which are acquired from the airline industry, is about two years old. Second, it's not fair to compare cost of a ticket purchased the day before a flight with a ticket purchased 11 months prior to the trip. It's not even fair to compare a February ticket to a May ticket. But, if you fly a route frequently -- say, Seattle to New York -- you get a good idea if you are overpaying regularly. Insight also makes it easy to compare airlines, which is particularly useful. For example, on a Seattle to Newark run, United carries the most passengers, but Alaska charges about 10 percent less. Scheduling concerns aside, it sure looks like some of those United passengers should consider Alaska. Lawson, by the way, says FlightAware is considering an update to the product, which would be a boon to travelers. But since you can't use the FlightAware's data to bargain for lower fares, it's mostly a "regret tool," as in, "Wow, I'm kind of a sucker for paying that much." I'd put wedding cost calculators into the same category. One of the best I found is at CostOfWedding.com. It allows lovebirds to enter all kinds of specifics, such as what kind of table gifts they expect to buy, and how fancy the reception food will be. Still, weddings involve so many details and decisions that wedding calculators are really only useful for after-the-fact comparisons. For example, CostOfWedding.com says a 75-person affair in suburban Washington should cost $21,700. That won't save you money if you are planning an event there, but it probably will make you feel good or bad if you've done so recently. Another regret tool is the "Location Affordability Portal," released in the past week by the U.S. Department of Transportation. It's supposed to help homebuyers more accurately predict the real costs of moving by adding in transportation costs -- in other words, that "drive until you qualify" home in the exurbs might not be as much of a bargain as it seems, once you add in the price of gas. The tool is very hard to use, however, and requires a lot of specialized inputs from users. At the moment, it's more useful to inspire "what might have been" daydreaming. Bargaining Tools Calculators that predict near-term costs are far more practical. Most of us have no idea what installation of a home electric circuit panel should cost, so plugging your ZIP code and your preferences into a tool before getting bids is incredibly useful. Use it to throw out a bidder who's asking for the moon. I like both HomeAdvisor and Homewyse.com. (In Columbia, Mo., upgrading a panel costs $866-$1,224, Homewyse says.) RedBeacon.com offers an even wider range of cost calculators for home services like landscaping or housecleaning. The most useful estimator I found unmasks the mystery of the costs of auto repairs, offered by RepairPal.com. Not only does RepairPal offer ZIP-code level pricing -- a water pump replacement should cost between $263 and $368 in north-suburban Seattle -- it also offers additional necessary information, like this: Water pump repairs often require belt replacement, particularly if fluid leaked on the belts. Getting a repair cost estimate takes only a moment, and it can save you hundreds at a repair shop. "We have had consumers tell us that, after they showed a RepairPal estimate, a shop lowered their price," said Bret Bodas, director of RepairPal's automotive professional group. Not surprisingly, auto mechanics weren't thrilled about the tool when it was first made public several years ago. But Bodas says fair pricing information helps honest mechanics, and the industry has slowly warmed to the idea of transparency. Napa Auto Parts actually licenses data from RepairPal for its own tool now. With both home and auto repairs, the data behind the calculator come mostly from cost estimation tools already used by contractors and repair shops. For example, automakers publish a list of labor times required for various repair jobs. Shops use those for estimates; RepairPal uses the same data, then adjusts for labor rates by ZIP codes, Bodas said. Naturally, consumers with broken-down cars aren't always in a great bargaining position. Still, RepairPal can make sure you aren't being taken for a ride, and it can even suggest you might be better off paying to have a vehicle towed to another shop for a second opinion, if the first shop's quote price is wildly off the mark. Sick consumers have even less bargaining power; for that reason, health care cost calculators like the helpful one you'll find at FairHealthConsumer.org almost qualify as regret tools. Still, it's worth knowing what medical procedures should cost before having those conversations with your insurance company and your doctor's office. And there are times when knowing you overpaid the dentist for your last crown gives you the power to pick a new dentist, so we'll call this a bargaining tool. And it's sometimes possible to negotiate price after the fact with providers; price comparison tools are useful in those discussions. By the same logic, the various taxi price calculators are also helpful in real time. No, you can't get a cab driver to negotiate a metered trip. But before visiting any new city, it's worth visiting a site like TaxiFareFinder.com and plugging in various trips you expect to take. You'll get a map of your route and an expected cost, so you'll know if your driver makes an unexpected wrong turn, and you can demand an adjustment. Anxiety Tools Predicting long-term future costs is fraught with peril; still, it's a good idea to know what you will be up against in 2020 so you can plan for the future. Before clicking on any of these sites, however, you might want to pour a nice cup of hot tea. They are likely to make your blood pressure rise. There's plenty of tools for calculating the cost of children, in the near and far future. Let's start small, like they do. Uncle Sam offers his own tool at USDA.gov, where the first-year cost of a kid in the Northeast is pegged at about $14,000. Look further into the future, and you may think twice about having a baby. Or at least about training that baby to be a scholarship athlete. BabyCenter.com thinks a child born in the Northeast today will cost $400,000 if she or he attends a private college. If you dial up cost of college calculators, you will conclude that the BabyCenter number is low. At CollegeSavings.org, you'll get an even starker splash of reality. Assume 5 percent tuition inflation -- and why not, that's how much colleges raise tuition each year at the moment -- at a four-year private school will cost $316,000 by the time today's babies graduate. (That's just tuition -- with room and board, the cost is $430,000!) Speaking of anxiety, you'll find hundreds of tools on investment sites offering to guesstimate how much money you will have, or will need, at retirement. Among the assumptions you'll see: average 12 percent market returns, spending levels remain at 80 percent after retirement, etc. You're already anxious enough.

“Today, the power of Morgan Stanley’s platform—a premier investment bank and one of the world’s pre-eminent wealth and asset management franchises—is clearer than ever before,” explained Gorman (right), in a statement. “With this milestone behind us, we have added momentum to carry out our full plan to achieve higher shareholder returns.”

“Today, the power of Morgan Stanley’s platform—a premier investment bank and one of the world’s pre-eminent wealth and asset management franchises—is clearer than ever before,” explained Gorman (right), in a statement. “With this milestone behind us, we have added momentum to carry out our full plan to achieve higher shareholder returns.”  Bloomberg

Bloomberg  Super typhoon hits the Philippines

Super typhoon hits the Philippines  Getty Images

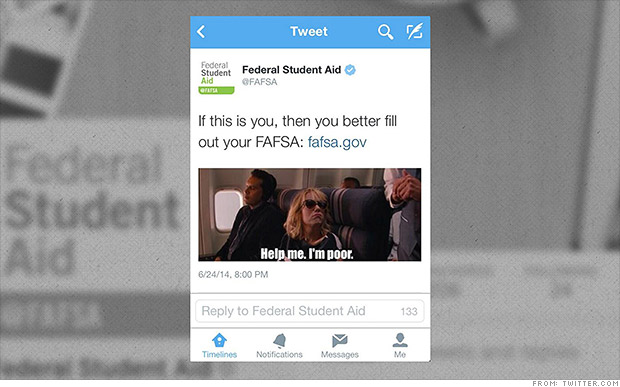

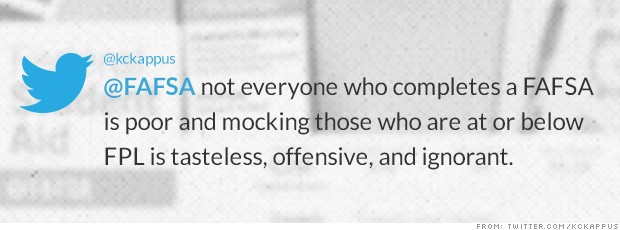

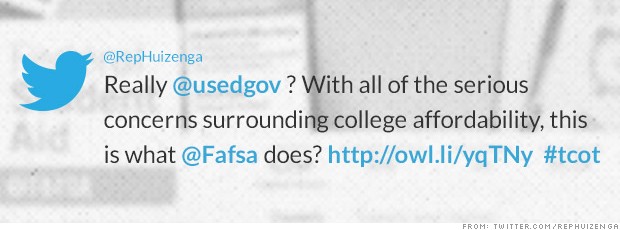

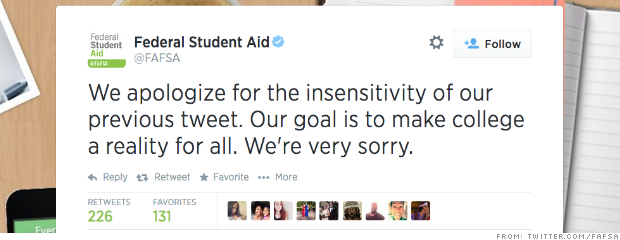

Getty Images  NEW YORK (CNNMoney) For social media managers, reaching young audiences with irreverent memes and tweets is a dangerous endeavor.

NEW YORK (CNNMoney) For social media managers, reaching young audiences with irreverent memes and tweets is a dangerous endeavor.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  15.99 (1y: +275%) $(function(){var seriesOptions=[],yAxisOptions=[],name='GTAT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1370581200000,4.26],[1370840400000,4.29],[1370926800000,4.13],[1371013200000,3.94],[1371099600000,4.06],[1371186000000,3.78],[1371445200000,3.77],[1371531600000,3.98],[1371618000000,3.99],[1371704400000,3.78],[1371790800000,3.735],[1372050000000,3.5],[1372136400000,3.52],[1372222800000,3.61],[1372309200000,4.11],[1372395600000,4.15],[1372654800000,4.065],[1372741200000,4.08],[1372827600000,4.17],[1373000400000,4.19],[1373259600000,4.2],[1373346000000,4.15],[1373432400000,4.2],[1373518800000,4.32],[1373605200000,4.38],[1373864400000,4.58],[1373950800000,5],[1374037200000,5.01],[1374123600000,5.08],[1374210000000,4.96],[1374469200000,5.07],[1374555600000,5.06],[1374642000000,4.95],[1374728400000,4.8],[1374814800000,4.74],[1375074000000,4.75],[1375160400000,5.1],[1375246800000,5.185],[1375333200000,5.175],[1375419600000,5.08],[1375678800000,5.18],[1375765200000,5.47],[1375851600000,5.39],[1375938000000,5.34],[1376024400000,5.32],[1376283600000,5.56],[1376370000000,5.74],[1376456400000,5.8],[1376542800000,6.03],[1376629200000,6.27],[1376888400000,6.04],[1376974800000,6.28],[1377061200000,6.18],[1377147600000,6.44],[1377234000000,6.69],[1377493200000,6.66],[1377579600000,6.31],[1377666000000,6.38],[1377752400000,6.54],[1377838800000,6.46],[1378184400000,6.71],[1378270800000,6.81],[1378357200000,6.78],[1378443600000,6.8],[1378702800000,6.93],[1378789200000,7.02],[1378875600000,6.95],[1378962000000,6.64],[1379048400000,6.57],[1379307600000,6.73],[1379394000000,6.89],[1379480400000,7.55],[1379566800000,8.35],[1379653200000,8.221],[1379912400000,8.2],[1379998800000,8.48],[1380085200000,8.47],[1380171600000,8.35],[1380258000000,8.385],[1380517200000,8.51],[1380603600000,8.74],[1380690000000,8.8],[1380776400000,8.77],[1380862800000,9.07],[1381122000000,8.79],[1381208400000,8.24],[1381294800000,7.99],[1381381200000,8.265],[1381467600000,8.135],[1381726800000,8.08],[1381813200000,8.1],[13! 81899600000,8.31],[1381986000000,8.359],[1382072400000,8.63],[1382331600000,9.13],[1382418000000,8.975],[1382504400000,8.45],[1382590800000,8.65],[1382677200000,8.17],[1382936400000,7.97],[1383022800000,8.01],[1383109200000,7.8],[1383195600000,7.495],[1383282000000,8.075],[1383544800000,8.38],[1383631200000,10.1],[1383717600000,9.85],[1383804000000,9.31],[1383890400000,9.47],[1384149600000,10.24],[1384236000000,9.97],[1384322400000,10.4],[1384408800000,10.295],[1384495200000,10.19],[1384754400000,9.93],[1384840800000,9.56],[1384927200000,9.44],[1385013600000,9.915],[1385100000000,9.82],[1385359200000,9.86],[1385445600000,10],[1385532000000,9.82],[1385704800000,9.81],[1385964000000,9.94],[1386050400000,9.28],[1386136800000,8.92],[1386223200000,8.89],[1386309600000,8.67],[13865688000

15.99 (1y: +275%) $(function(){var seriesOptions=[],yAxisOptions=[],name='GTAT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1370581200000,4.26],[1370840400000,4.29],[1370926800000,4.13],[1371013200000,3.94],[1371099600000,4.06],[1371186000000,3.78],[1371445200000,3.77],[1371531600000,3.98],[1371618000000,3.99],[1371704400000,3.78],[1371790800000,3.735],[1372050000000,3.5],[1372136400000,3.52],[1372222800000,3.61],[1372309200000,4.11],[1372395600000,4.15],[1372654800000,4.065],[1372741200000,4.08],[1372827600000,4.17],[1373000400000,4.19],[1373259600000,4.2],[1373346000000,4.15],[1373432400000,4.2],[1373518800000,4.32],[1373605200000,4.38],[1373864400000,4.58],[1373950800000,5],[1374037200000,5.01],[1374123600000,5.08],[1374210000000,4.96],[1374469200000,5.07],[1374555600000,5.06],[1374642000000,4.95],[1374728400000,4.8],[1374814800000,4.74],[1375074000000,4.75],[1375160400000,5.1],[1375246800000,5.185],[1375333200000,5.175],[1375419600000,5.08],[1375678800000,5.18],[1375765200000,5.47],[1375851600000,5.39],[1375938000000,5.34],[1376024400000,5.32],[1376283600000,5.56],[1376370000000,5.74],[1376456400000,5.8],[1376542800000,6.03],[1376629200000,6.27],[1376888400000,6.04],[1376974800000,6.28],[1377061200000,6.18],[1377147600000,6.44],[1377234000000,6.69],[1377493200000,6.66],[1377579600000,6.31],[1377666000000,6.38],[1377752400000,6.54],[1377838800000,6.46],[1378184400000,6.71],[1378270800000,6.81],[1378357200000,6.78],[1378443600000,6.8],[1378702800000,6.93],[1378789200000,7.02],[1378875600000,6.95],[1378962000000,6.64],[1379048400000,6.57],[1379307600000,6.73],[1379394000000,6.89],[1379480400000,7.55],[1379566800000,8.35],[1379653200000,8.221],[1379912400000,8.2],[1379998800000,8.48],[1380085200000,8.47],[1380171600000,8.35],[1380258000000,8.385],[1380517200000,8.51],[1380603600000,8.74],[1380690000000,8.8],[1380776400000,8.77],[1380862800000,9.07],[1381122000000,8.79],[1381208400000,8.24],[1381294800000,7.99],[1381381200000,8.265],[1381467600000,8.135],[1381726800000,8.08],[1381813200000,8.1],[13! 81899600000,8.31],[1381986000000,8.359],[1382072400000,8.63],[1382331600000,9.13],[1382418000000,8.975],[1382504400000,8.45],[1382590800000,8.65],[1382677200000,8.17],[1382936400000,7.97],[1383022800000,8.01],[1383109200000,7.8],[1383195600000,7.495],[1383282000000,8.075],[1383544800000,8.38],[1383631200000,10.1],[1383717600000,9.85],[1383804000000,9.31],[1383890400000,9.47],[1384149600000,10.24],[1384236000000,9.97],[1384322400000,10.4],[1384408800000,10.295],[1384495200000,10.19],[1384754400000,9.93],[1384840800000,9.56],[1384927200000,9.44],[1385013600000,9.915],[1385100000000,9.82],[1385359200000,9.86],[1385445600000,10],[1385532000000,9.82],[1385704800000,9.81],[1385964000000,9.94],[1386050400000,9.28],[1386136800000,8.92],[1386223200000,8.89],[1386309600000,8.67],[13865688000