Our Seeking Alpha followers know that one of our favorite times to buy and trade stocks is when they may have hit technical and fundamental bottoms. We are constantly scanning for "bottom bouncers" and historically have had particularly good fortune with healthcare stocks that have upcoming catalysts or news. We called our latest successful bottom bounce for CEL-SCI (CVM) in our last Seeking Alpha article after surviving a de-listing notice, a reverse stock split and a capital raise. That stock has traded more than +/- 8% higher since.

This week, we focus our sights on another biotech firm whose Risk/Reward profile has been getting some increased attention and volume despite similar adverse conditions: Zalicus Inc. (ZLCS), whose previously touted "Upcoming Catalyst With Huge Potential" analysis of the firm by Jason Napodano, CFA appears to have taken on even greater significance within the last 72 hours.

A news announcement proclaiming that the FDA is proposing new restrictions that would change regulations for some of the most commonly prescribed narcotic painkillers on the market in an effort to combat "misuse and abuse" is calling attention to ZLCS. The FDA's latest proposal would specifically affect hydrocodone combination pills, also known as opioids. Higher priced stocks for firms that make those pills like AbbVie Inc. (ABBV), Actavis plc (ACT), Teva (TEVA) and Mallinckrodt plc (MNK) felt just a small pinch after that regulatory news picked up very wide coverage, but it could have tremendous impact on the approval chances for some of the drugs in Zalicus' pipeline.

On Friday, shares of Zogenix (ZGNX) soared after the Food and Drug Administration approved Zohydro ER - an extended-release version of the same (hydrocodone) narcotic painkiller despite an earlier recommendation by its own advisory committee that the drug should be rejected because of its potential for abuse. Amarin (AMRN) followers took note of that approval which went against the committee's recommendation for sure.

The landscape of anticipation for ZLCS' upcoming PHASE IIa clinical data event has completely changed in scope given that Zalicus discovers and develops novel treatments for patients suffering from pain; all without the multiple, incredibly dangerous and negative side-effects which have become the target of vocal consumer groups, physicians and even politicians like Rep. William Keating (D., Mass.) who told the Wall Street Journal that, "Just as the FDA was making some steps forward in the fight to end prescription drug abuse, they take major steps back with the approval of Zohydro ER." Shares of ZGNX have begun to lose some of that value following their approval, but that is certainly not unusual given profit-taking after these types of events.

Although ZLCS has a portfolio of these proprietary clinical-stage product candidates targeting pain, the firm has also entered into multiple revenue-generating collaborations with large pharmaceutical companies relating to other products, but the two pending catalysts for its leading clinical candidate Z160 are what has been bringing attention and volume spikes to the stock.

Zalicus selected the most promising formulation for clinical use and advanced Z160 into two Phase IIa clinical trials for the treatment of neuropathic pain, including postherpetic neuralgia, or PHN, a painful neuropathic condition resulting from an outbreak of the herpes zoster virus, otherwise known as shingles, and lumbrosacral radiculopathy, or LSR, a common neuropathic back pain condition resulting from the compression or irritation of the nerves exiting the lumbar region of the spine. The trial in LSR began in August 2012, and the other one in PHN began in December 2012. Top-line results for these trials are an incredibly important binary event expected to be announced within the next couple of weeks.

Z160 is a first in class, oral, state dependent, selective N-type calcium channel blocker that has the potential to be used for a wide variety of chronic pain conditions. Interestingly, last month, Zalicus received Orphan Drug Status from the FDA for Z160 as a potential treatment for postherpetic neuralgia.

In his most recent analysis, the normally conservative CFA, Jason Napodano, has been jumping up and down about this being an undervalued biotech play with the added bonus of upcoming clinical data in several recent articles. He also points out that Z160 a "potentially an enormous drug if it works in both PHN and LSR." More specifically, Napodano says positive results from these two studies may point to a target price of around $14 after some discounting back to the present for Zalicus shares. The stock is currently trading just under $5. The analyst is looking for data "by the middle of November" and he should know after sitting down with Mark Corrigan, MD (Chief Executive Officer) and Justin Renz (Chief Financial Officer) of ZLCS to discuss the drug in detail.

Enhydris Private Equity, Inc. points out that "the current market leader in the neuropathic pain market is Pfizer's (PFE) Lyrica- which is on track to break the $2B mark this year and has shown steady growth since its 2005 launch. Moreover, sales of Eli Lilly's (LLY) Cymbalta for neuropathic pain are also expected to exceed $1B in 2013, showing the strength of this rapidly growing niche-market. Compared to Zalicus' market cap, Z160 thus offers investors a potentially outstanding reward going forward."

In fact, Zalicus has spent the past several years improving the formulation of a drug that "Did not demonstrate the ideal pharmaceutical characteristics considered necessary to advance the compound further into development" when Merck & Co. (MRK) walked away from the compound in 2007-- after they had licensed the compound (originally named NMED-160) for $25 million upfront and potentially as much as $450 million in milestones and royalties on sales.

From a technical standpoint, we see an interesting chart that has been spiking recently, but oddly enough, almost just as quickly giving back gains. It's not unusual to see this type of "nervous" activity - particularly since the firm had a delisting notice which forced management to pull the trigger on a 1-for-6 reverse stock split. That allowed Zalicus to regain compliance with the $1.00 per share minimum bid price requirement for continued listing on The Nasdaq Capital Market. But as seen time and again after these stock splits, many inexperienced or simply anxious investors wake up to see that the penny stock they were holding is now worth $5 and they tend to sell without thinking things through.

What does look promising as we look at the chart is that each time there has been a spike, we've seen higher highs-particularly with the pre-split spikes which occurred before early October. The "predictability" may continue and here is why:

This latest spike was a post-split spike that moved the stock very quickly given its now very low float. In fact, by some estimates, 25% of the new "small float" was traded within two sessions late last week. That points to a lot of new buyers who came in and accumulated oversold shares. This volume activity added new eyeballs and interest to ZLCS' upcoming binary catalyst, while relieving some of those inexperienced (or anxious) sellers of the shares who realize that a failure of both Phase II trials would undoubtedly be the end of Zalicus since that would sink the stock and make it nearly impossible to finance the remainder of its drug pipeline.

As the company states in their latest 10-Q, they only have enough money to keep operating until approximately February of next year. But just as Enhydris pointed out, even if Zalicus would have to rely heavily on its $25 M purchase agreement with Lincoln Park Capital to keep their doors open, that amount would not give the company nearly enough cash to perform a pivotal Phase III trial for Z160-assuming one or both of its current Phase IIa trials are successful.

So with the timing of this trade now building to a critical stage given the expected release of data, one has to wonder whether another sharp spike after positive clinical data news might not be a better time to raise capital at much higher prices (following positive data?) than after a devastating announcement that could set the company back to a share prices below $2.

Another factor that is interesting for experienced traders looking closely at the price action for hints about the upcoming catalysts is that companies usually cue up and execute reverse splits when will have enough good news lined up to support the stock "sell off" that occurs after a reverse split takes place. So far, the company has been relatively quiet and only announced the very positive Orphan Drug Status from the FDA for Z160 well before the split became official. Are they feeling so confident about the upcoming results that they haven't had to pad the post-reverse split sell-off with any news?

In speaking to other people who have followed this company for some time, they say that Zalicus management has not been known for playing games and that historically speaking, at least, they tend to be conservative and on-time with announcements about forward looking events. That history points to the data being delivered either on time- or even early.

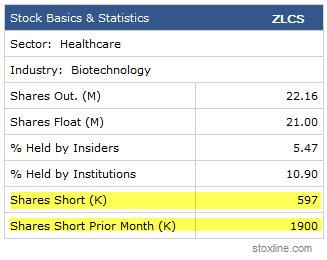

Sure, we like Zalicus as a bottom bouncer at these levels for all of those fundamental and some technical reasons as well. In fact, the stock could attempt to make another push to $6 before data once again given that this is now a very low floater (with 5.47% held by Insiders and 10.90% held by Institutions) that can move up quickly on increased volume and buying pressure. It certainly has an increasing number of retail followers on both sides of the bet.

(click to enlarge)

Once the stock failed to break through the previous level of support at close to the $5.32 mark late last week, shorters poured in for a quick trade. They were right to do so when the action broke down, but many have already begun to cover (see chart below) as they fear a surge in price action might push them higher as the release of data gets increasingly closer. Since we are clearly now entering that catalyst window, stats show that the risk/benefit ratio has begun to push many of those shorts out.

Obviously, Zalicus's various approaches to drug discovery and development using their ion channel expertise or their cHTS technology platform are complex, but the mechanism of action for Z160 has been validated by ziconotide, marketed by Jazz Pharmaceuticals (JAZZ) as Prialt- which has well-documented clinical efficacy.

Still, for all the excitement building here, previously unrecognized or unexpected defects in or limitations to Zalicus's drug discovery technologies or drug development strategies may emerge from these or other future studies. Early stage drug development offers high risk of failure and no one can predict when or if any one of Zalicus's product candidates will receive regulatory approval, though we can all agree that such approval is years away.

One thing is clear, the future of ZLCS' success depends on the successful development of Z160 and the scientific evidence to support the feasibility of developing drugs that modulate ion channels to treat pain conditions is possible. Still, many companies have failed to successfully develop drugs that modulate ion channels to treat pain conditions.

That doesn't make the proposition offered by this next generation of drugs any less compelling and one video featuring Dr. Terrance Snutch, PhD, FRSC, discussing his research into understanding and treating chronic pain is certainly worth a look to those wishing to understand the mechanisms of action here. It is simply fascinating stuff if you're into medical biotechnology at all.

Remember, this is a short term trade for us. Zalicus's approach to drug discovery and development may not be successful but even if Zalicus' approach is theoretically viable, they will have obtain the financial resources required to further develop and advance this promising product candidates through the rest of the clinical trial process and obtain the regulatory approvals required for commercialization around the world and we don't want to stick around for that inevitable capital raise.

Remember also that we hedge our bets on these bottom bouncers by basing these picks on not only the fundamental factors and upcoming news, but also by using our advanced charting and market analytics formula which looks for trending factors on a stock chart, including an analysis of the firm's Weekly Williams %R (both one and two sessions ago) as well as the Stock's Weekly Relative Strength Index (also for the past several sessions), and other factors such as Bear Power (BEARP) and Bull Power (BULLP), technical analysts are able to set and apply various histograms. We are also tracking other specific points on the Moving Average Convergence Divergence of a stock and in the end, coming up with a mathematical formula which yields these specific results.

Best of luck and our best wishes for your continued success traders!

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in ZLCS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment