Overview

As the S&P 500 (SPY) is trading just shy of its all-time nominal high, there are still many headwinds facing the U.S. equity market that have the potential to derail the rally. A few potential risks to the rally are highlighted in the rest of the article. Many view that the current bull market in U.S. equities is being at least partly fueled by the Fed's quantitative easing and the accompanying low rate environment, as it pushes all of types of investors out on the risk curve and eventually into equities-- simply to earn positive real returns. Additionally, unemployment remains rather high, especially given the massive amounts of easing that the Fed has already implemented. Also, the market is trading at a rather rich P/E multiple. The three risks to the market discussed in this article provide reasoning as to the problems that the rally faces and why it may be a good idea to "sell in May and go away".

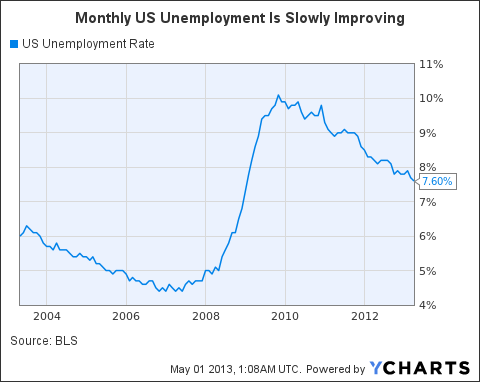

1: Persistent Unemployment

Since the financial crisis of 2008, U.S. unemployment has been significantly higher than what Americans would have expected at this point in the recovery. Currently, U.S. monthly unemployment sits at a rather high 7.6%. The Fed is looking to lower that rate, and has hinted that it may leave its expansionary monetary policy in place until the rate lowered even more. Yet, eventually as unemployment returns to normalized levels it may soon lead the Fed to adjust its policy initiatives.

US Unemployment Rate data by YCharts

2: The Eventual Fed Exit

I believe that the most pertinent risk to the rally is a signaling that the Fed will end its easy money policy in the near or medium term. This potential move would have the Fed significantly decrease its expansionary monetary activities and could hit the equity market hard. As the Fed balance sheet has ballooned in rece! nt years, the Fed exit is becoming an increasingly large topic of debate, and many are trying to figure out when this may happen. Chairman of the Fed, Ben Bernanke's term ends in January of next year, and some have speculated that it may take a leadership change at the Fed in order to implement an effective exit from years of QE.

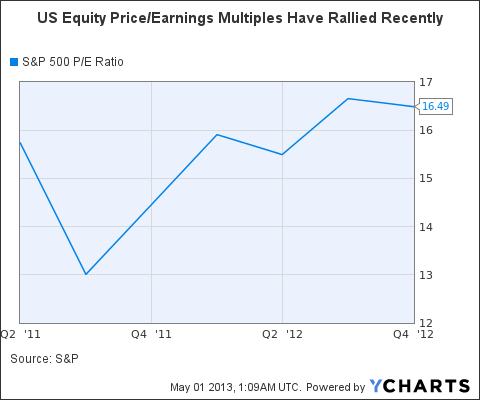

3: Multiple Expansion Seems to be Limited from Here

Over the last few years, P/E multiples of the S&P 500 have increased substantially and have played a rather large part in the rally in equity prices. Yet, I believe that further multiple expansion is extremely limited. Currently, the S&P 500 trades around 16.5x earnings. This multiple does not signify a cheap market by any means, and makes it apparent that there is not a significant amount that P/E multiples can increase from this point, especially considering historic market multiples.

S&P 500 P/E Ratio data by YCharts

Conclusion

The S&P 500 is trading near an all-time nominal high and given the risks to the economy, it makes sense for savvy investors to at least take some profits at this point, and even follow the adage, "Sell in May and Go Away".

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment