SunPower (SPWR) is one of the largest integrated solar companies in the world and produces the most efficient crystalline silicon solar panels. The company has seen a large stock price appreciation in the last one year, as it has recovered from the brink of bankruptcy. SunPower has become more competitive with Chinese crystalline solar panel makers like Canadian Solar (CSIQ), Yingli Green Energy (YGE), etc. by expanding rapidly into the downstream solar development segment and winning some large multi-year utility deals. The company has also been helped by continued capital support from the backing of its parent Total (TOT). This has proved to be extremely important as the solar development business is capital intensive and the industry has been suffering huge losses in the last couple of years. I had advocated buying SunPower around six months ago as the best US solar stock. The stock has risen by more than 100% since that point in time and I think it is the right time to take profits off the table. Investors can consider some other equally good solar stocks such as ReneSola (SOL) and JinkoSolar (JKS) which have good fundamentals and have not seen a sharp stock price increase.

Why it is time to take some Profits

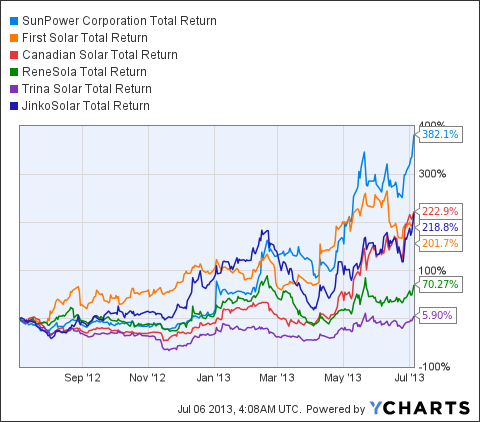

1. Stock Price Increase - SunPower's stock has increased rapidly over the last one year as the clouds of bankruptcy have cleared. The solar industry is also returning to a better supply demand balance with massive growth in solar demand in Japan and China. SunPower has increased by ~380% over the last one year and ~280% YTD, making it one of the best solar stocks to own during this period. Other solar stocks especially the Chinese ones have not increased that much. I think given the sharp price increase, the probability of a higher increase is becoming limited.

SPWR Total Return Price data by YCharts

2. Valu! ation - SunPower's valuation has also increased sharply along with its stock price. The stock valuation at a P/S of 1.1x and a P/CF of 9x is no longer cheap. The Chinese solar stocks are trading at a P/S of 0.2-0.4x, which makes them more attractive in my view. There are suggestions that Europe and China will come to an agreement to avoid a costly solar trade war. This will help the Chinese companies continue their European dominance.

3. USA centric - SunPower is very strong in the USA but does not have enough penetration in the other fast growing geographies. The company has a negligible presence in the Chinese solar market, which will account for almost 30% of the global demand in 2013. SunPower has benefited from its strong domestic advantage but it needs to increase focus on non-USA countries in order to grow.

In Q1, non-GAAP North American revenue rose 13% year-over-year to $423 million, accounting for 74% of total revenue with a non-GAAP gross margin of 33%... n EMEA, non-GAAP revenue was $69 million, down sequentially in year-over-year. Megawatts recognized declined 28% sequentially, primarily due to seasonality

Source - SunPower

4. Cost Gap - SunPower suffers from a cost disadvantage as compared to the other solar panel makers. The Chinese solar panel makers have managed to dramatically cut costs such that decent quality solar panels can be made at 50-55c/watt, while SunPower makes solar panels at almost 90c-$1/watt. Though SunPower panels have greater efficiency, the cost gap still remains quite large.

5. Profits are still some time away - SunPower has been making losses in the last two years like the rest of the solar industry as solar panel ASPs have fallen below costs due to massive overcapacity. The company may not be profitable in 2013, though it expects to generate $100-200 million in free cash flows. SunPower expects revenue of $2.6-2.7 billion with a gross margin of 15% to 17% and EPS of -$0.05 and $0.20.

6. Global Overcapacity in Solar Panels - The g! lobal sol! ar industry is still facing the problem of too much supply as compared to the demand. It will take another year or two for the industry to return to a more even supply and demand. The current boom in Japan and South Africa has boosted the depressed solar panel ASPs. However, countries can be fickle with their solar subsidies and demand can crash with a change in any key country. The solar industry is now heavily dependent on China and Japan and any change there could harm the industry.

SunPower Advantages

1. Strong downstream operations - SunPower was one of the first solar panel companies to realize the importance of getting into the downstream segments of solar panel installation and development. The company acquired a big US solar panel installer Powerlight and has never looked back. The company has tremendous strengths in the commercial and utility areas of the US market. It also has a very strong presence in the residential solar market. The company recently won huge solar plant contracts with MidAmerican.

2. Most efficient Solar Panels - SunPower makes the most efficient silicon solar panels on a commercial basis. Its high efficiency solar cells made through a proprietary process are used in making solar panels that convert a large part of sunlight into electricity. This allows SunPower to charge a premium for its panels and gives it an edge in the area constrained residential solar market.

During the quarter, we launch our new X-Series panel with world record efficiency of 21.5%. This panel is particularly well-suited for the rooftop market where its higher efficiency, energy delivery and superior reliability offer significant levelized cost of energy savings.

Source - SunPower

3. Total Backing - SunPower managed to sell a substantial stake to the French oil giant Total during the start of the current industry downturn. This move probably saved SunPower from bankruptcy, as the parent has pitched in with crucial debt and equity infusions to offset the cash outfl! ows. It h! as removed the bankruptcy risk as many top solar companies such as Q-Cells and Solyndra have shut down.

Summary

SunPower has more than doubled after I had singled it out as the best US solar stock to own (other solar panel stock have also done well). This has led to the stock valuation doubling and makes it less attractive in my view. The company's fundamentals remain decently strong and there are tailwinds in the form of a better supply demand balance in the industry. However I think that there are better opportunities in the solar space, as a lot of the good solar stocks have not seen the same price increase and trade at very depressed valuation multiples. SunPower may see a small correction or consolidation as it seems to be a bit overvalued in my opinion right now.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment