It looks as though I was wrong -- Intel (INTC) had to bite the bullet and guide down for the year. Instead of low single digit growth, it seems that 2013 is going to be a flat year for the company (in line with consensus, fortunately enough). However, I believe that the devil is in the details here, and that following what will surely be capitulation over the next couple of sessions, there will be a gradual realization that the sky isn't falling for the company and that under this new CEO, shares -- and indeed, the underlying business -- can finally return to very healthy, profitable growth. Keep in mind as you read this article that I am speaking from a multi-year perspective and not necessarily trying to give short-term trading advice. With that, let's dig in.

The Datacenter Story May Make Some Uneasy... But It's Okay

One thing that I found uninspiring during this release is that the data-center was essentially flat Y/Y during Q2. This, coupled with modest ~6% growth in Q1, optically does not bode well for a "low double digit" growth story for the full year. This suggests a rather dramatic ramp during the second half. As I have detailed in previous articles, I believe that this is quite plausible given that the entire product lineup is long overdue for a refresh that will be coming in Q3 and Q4. We have the "Haswell" based Xeon E3 parts for entry level servers, and micro-servers. On top of that, the Romley platform sees a new processor known as "Ivy Bridge EP" that should bring ~50% more cores within the same power envelope (this decreases TCO as performance/watt improves dramatically). Finally, the very high end, "expandable" market that scales from 2-8+ sockets sees a very long overdue refresh from Westmere EX to Ivy Bridge EX. In the same power envelope, Intel will release 15 core parts, and each core should clock higher and offer ~25% more performance per core, per clock.

It is important to note that Intel will also be rolling o! ut its new part known as "Avoton" based on the "Silvermont" micro-architecture during 2H 2013 (I am expecting a late July/early August launch) for micro-servers, and another part known as "Rangeley" for networking. The company mentioned on the call that networking, cloud, and storage have been growing at 20-40%+, and I believe that the release of "Avoton" should catalyze further growth.

The PC Client Group Hiccup

The main driver behind the guide down was the weakness in the traditional PC market. Notebook units for the quarter were down 7% Y/Y and ASPs saw a hit of ~4%. While AMD (AMD) isn't likely to be too thrilled that the company more aggressively competed at the low end on price, this was necessary for the company to try to hit guidance. Desktops seem to have almost bottomed, with units down only 3% Y/Y but ASPs up 6%. I expect that Intel will try to drive a richer mix as it continues to integrate more onto its PC chips (including multiple higher tiers of graphics), but this is a longer-term story.

Now, as I have suspected for quite a while, it isn't the high end of the PC market that is getting hit by tablets. In fact, CFO Stacy Smith had this to say on the call:

And if you look at the last three years even in a time where the market's been relatively weak, the Core i5, i7 volumes have been very healthy and if anything we've seen a larger mix overall to Core over that time period.

So you don't have tablets replacing high end PCs, you have tablets replacing the relatively high volume, low end PCs into which Intel shipped a large number of Pentium and Celeron chips. Now, luckily the Pentium/Celeron chips move to the upcoming "Bay Trail" design going forward, which means that they all become fanless, thinner, and much more amenable to convertible designs at low price points (this could drive volume). Also keep in mind that a move from a 2-chip solution to a single chip solution based on cores designed to be much smaller w! ill yield! significant gross margin benefits at flat ASPs.

But the truth is that Intel needs to get Bay Trail out as quickly as it can, and quite frankly I don't think even Intel realized how urgently it needed to get this part out until the beginning of the year (as all of the leaks from 2012 suggested that Bay Trail was a 2014 part). I am glad that this lineup was accelerated to late 2013.

The Tablet And Smartphone Push: It's Do Or Die

Quite frankly, in terms of the consumer computing space, it is imperative that Intel get into these markets and in force as quickly as possible. Now, unlike what some have suggested, the tablet and smartphone vendors appear to want Intel in this space, as Mr. Krzanich noted when asked about customer response to Intel's attempts to enter this space:

I'd say the key message that they've been giving us is, we really want you there, we see the products coming, we want even more and we want a faster line up following those.

But the main problem that we have seen so far is that Intel needs to have the right products to play in this space. I think that when Intel can put the old Atom behind it and get the first Silvermont based parts to market, then we will see some real volume growth. Intel is lucky that ARM (ARMH)-based competitors such as Qualcomm (QCOM) and Nvidia (NVDA) are essentially locked out of the Windows space (and as a result, Intel captured 90% of Windows tablet share translating into ~6% of the total tablet market), but in the Android space, X86 compatibility is not a barrier for competitors, so Clover Trail+ isn't going to cut it against an Nvidia Tegra 4 or a Qualcomm Snapdragon 800. Bay Trail had better be good (i.e., best in class), otherwise it will fail to gain traction on Android.

The long and the short of it is: tablets and low cost convertibles will become the mainstream computing devices of the future for the vast majority of people. While the high margin, high ASP Core i5/i7 will continue to do well, the mainstream parts need! to trans! ition to the Bay Trail design as quickly as possible for Intel to be able to participate in this broad form factor transition. Fortunately, the Atom SoCs that go into this space are likely much cheaper to make than the cut-down Core processors that become Pentiums/Celerons that sell for ~$40-$50, so gross margins on these parts are likely to remain stable to perhaps slightly up as these chips ramp in full-force. Blended gross margins come under slight pressure, as it is the low end/low power part of the compute market that will see growth while the high end is likely to be slightly up to flat.

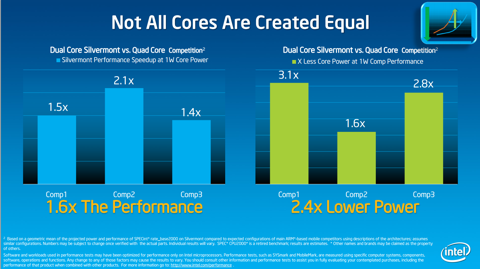

For growth, Intel also really needs to play in the smartphone space on both baseband and apps processor. If Intel can deliver on the performance/power claims in the following slide, then I believe that this could drive significant adoption of the company's parts in mid to high end smartphones.

(click to enlarge)

However, I expect that Intel is at risk of having a significant marketing problem trying to sell a dual core product into a world of quad core phones, even if the dual core part delivers better performance/watt. I further expect that from what is currently known about Bay Trail's GPU (4 EU Gen7 GPU), it is unlikely that -- unless Intel is either using Imagination's (IGNMF.PK) next generation PowerVR 6 or a beefed up Gen7 design for the "Merrifield" SoC -- it will be as competitive with the Snapdragon 800 on the GPU side of things, which could pose as an additional headwind to adoption. I also believe that the Q1 2014 launch curtails any hope that there will be a 14nm smartphone product launched in 2014 (although Mr. Krzanich's comments about "acceleration" could be a source of optimism here), which means that the company's process lead could ultimately prove to be ephemeral in this particular end market. Fortunately, product cycles in this ! space are! short, so it may be okay to have Merrifield be reasonably short lived.

Finally, it will be an uphill battle for Intel to compete with Qualcomm on the modem side of things, although recent hiring and R&D increases suggest that Intel is making a serious effort. It is not clear if the "Merrifield" platform will ship with an LTE-Advanced modem (which both Broadcom (BRCM) and Qualcomm will be shipping in this timeframe). I am expecting a highly integrated part known as "6331" during 2014, which will put the modem on the same die as the apps processor, although it is clear that Intel's modem efforts have significantly lagged its apps processor efforts significantly thus far. I also expect that Intel will need to fill out its portfolio with low power WiFi connectivity as consuming the majority of the bill of materials in this space will be key to driving high margin revenue growth. This can likely be developed in-house by leveraging existing WiFi IP, although I would not be surprised to see further acquisitions.

A Note On Sentiment

I am not oblivious to the fact that Intel has been a frustrating and disappointing stock. Long-term holders are likely furious that the company is guiding to flat Y/Y revenues in this bull market, after years of seeing their investment go nowhere at the speed of light. The opportunity cost to holding Intel shares likely feels high, particularly as growth names tend to be outperforming in this market, and Intel is not invulnerable to broad market weakness, which in the near term could create a pretty negatively skewed risk/reward profile for the name.

But the bottom line is that Intel still exhibits a favorable risk/reward for investors with the patience to stick through at least until the core thesis has played out long enough to drive significant upside. What is the thesis, exactly?

Intel will gain enough share in tablets (which have a much larger TAM than the low end PC market today and will continue to grow) to offset low end PC! sales de! clinesIntel's datacenter growth story will remain on track with a double digit revenue growth CAGR through 2016The low end PC will merge with the high end tablet, and Intel will have significant share hereThere is plenty of volume in cheap 7" tablets to drive growth, and Intel will have a leadership product hereIntel has the scale and the ability to invest in order to take significant share in the Android smartphone spaceIntel will be significantly expanding its processor TAM into new end markets such as low end networking, communications infrastructure, in vehicle infotainment, and wearable devicesWhile the current year's financial results are more than likely to be disappointing (full year guide being cut was a major disappointment to bulls), Wall Street reacts favorably to stories that are showing signs of improvement. For Q3 and Q4, gross margins are back into the 60% range. The CapEx guide has been cut yet again, and total spending has been cut for the year. The launches of Bay Trail and the next gen micro-server SoC known as "Avoton" are imminent (which could drive sentiment), the upcoming investor meeting should be a positive catalyst, and I believe that Q1 2014 should be the start of a real growth story for the company as the full year impact of the new product lineup is realized.

More importantly, I believe that the new CEO will be well received by the Street. If you notice on the call, he was very eager to emphasize the "Atom" parts and did not act as though Intel was a PC-first company and regarded Atom as a second-class citizen. This new CEO understands that low power SoCs designed quickly in a fast-pace environment is the future for the majority of compute, and I expect that going forward, he will not be shy about pursuing new and emerging opportunities even if it means "cannibalizing" pre-existing markets (as Intel was apparently afraid of given its historically low focus on Atom and attempts to reinvigorate the traditional PC market).

Fina! lly, I be! lieve that the full year guide down was done to make sure that Intel is not at risk of missing in Q3 or Q4. I expect that the Q3 guide -- which was at the low end of the traditional seasonal increase -- was very conservative, and if Haswell Ultrabooks do, indeed, pick up, there is a chance for a beat. Optically, Intel has been "missing" its guidance for the last several quarters, and I believe that the new CEO and the current CFO are tired of getting egg on their faces. Paul Otellini did not leave as a CEO who was known for delivering shareholder value (despite the massive revenue growth and PC/server leadership under his reign), and I get the sense that the company is looking to change this. Intel will -- if I'm right -- become a company that blasts through expectations, not one whose quarterly results causes investors to cringe. While I was initially irritated by the guide-down, I realize that in this uncertain demand environment, I would do the exact thing in Mr. Krzanich's and Mr. Smith's places. This is the one grace period before Mr. Krzanich's tenure begins properly, and it's best to get that sort of thing out of the way.

Conclusion

Look, we all already knew the PC market was not doing so great, and the fact that Intel is going to be flat for the year isn't wonderful, but it's not the worst thing possible. If you are a long-term investor, recognize that this is a marathon and not a sprint, and all of the signs that Intel is doing the right thing to position itself for long-term growth are there, even if the short-term results take a hit. It takes time (4 years) to design new chips for new power/performance targets, and what you are seeing now is a company that completely miscalculated when it would need a new Atom. In 2009/2010, when Intel bought Infineon's wireless and started taking Atom more seriously, it had no idea that the PC market would go into such steep decline; even 2011 was a banner year in terms of the top and bottom lines. This was supposed to be an incremental! opportun! ity to spur further growth on top of what seemed to be a pretty healthy business.

But the past is the past, and we will see Bay Trail in 2013, Merrifield and Cherry Trail (Airmont based) in 2014, and I think that the company can finally return to growth. Long-term investors need to wait a little bit longer for the growth story to play out, and I don't blame you at all if you just want out to go participate in a much "easier" growth story. But as far as I'm concerned, Intel is a top notch, all-star company that made a really dumb decision that it is now in the process of correcting. If I am right and the company can push hard in this new world of ubiquitous compute, then all will be well, the massive R&D investments that have ravaged the net income line will pay off, and shareholders can finally move beyond the "lost decade" in Intel's shares.

I'm betting on Intel.

Disclosure: I am long INTC, QCOM, NVDA, AMD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment