There are just three weeks left in the first half of 2013. As we approach the second half of the year, it's time to look at a name that I called a second half growth story for 2013. Chip giant Intel (INTC) fits this bill perfectly, as revenues are finally expected to start growing again. While shares have already rallied strongly this year, there is the potential for more upside should Intel get back into the black. Today, I'll show why it is Intel's time to shine.

Recent revenue history:

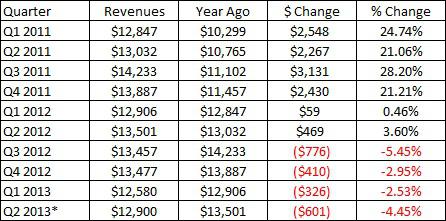

The table below shows Intel's revenue history against year ago periods going back to the start of 2011. Dollar values in millions.

*Projected based on midpoint of Intel's Q2 guidance.

After growth of 21% or more during each quarter in 2011, Intel's first two quarters of 2012 showed less than 4% year over year growth. Then we went negative, with three straight quarters of 2.5% declines or worse. A weak PC industry was to blame, and this year's Q2 is forecast to be a little worse.

Looking at the current Q2:

When Intel reported Q1 results, they guided to revenues of $12.9 billion, plus or minus $500 million. Even at the high end of the range, $13.4 billion, Intel would still report about a $100 million year over year decline. It seems extremely likely that Intel will report a fourth straight quarter of declines, and analysts are expecting that $12.90 billion figure. Interestingly enough, the analyst range goes from $12.70 billion to $13.02 billion. That equals more downside from the midpoint than upside, not surprising given Intel has disappointed in recent quarters. To be fair, analysts have brought up their average since Intel reported Q1. At that point, the analyst average stood at $12.87 billion.

On the Q1 conference call, Intel referenced the second quarter as the start of their 2013 launch period:

In the second quarter, we w! ill launch Haswell, enabling a new wave of ultra-sleek designs across multiple form factors by our customers. We believe the combination of an improving macroeconomic environment, Haswell coming to the market; ultramobile form factors like ultrabooks, convertibles, and tablets; and touch-enabled devices leads to a return to growth in the second half of the year.

Haswell has been much discussed in recent months, and here's a in-depth guide for you. Haswell should provide some help to Q2 numbers, which is why the $12.9 billion figure would represent some nice sequential growth over Q1's $12.58 billion figure. We're still looking at a year over year decline, but at least the numbers are starting to turn. You have to learn to crawl before you can walk.

Looking forward to the second half:

Before I get into the financial aspect, here's what the company has coming later this year. Again, the following statements are from the Q1 conference call:

At IDF Beijing last week, we announced that our next-generation Atom processor for the microserver segment of the market, code named Avoton, and our Ivy Bridge product for Xeon [cloud] servers, will be shipping in the second half. These leadership products, coupled with our leading-edge [process] technology and the secular growth trends of the data [center] markets, give us confidence in double digit revenue growth for the year.

We are making significant progress in tablets and phones. First quarter tablet volume more than doubled from the fourth quarter, and we expect it to double again in the second quarter. We have shipping designs across both Windows 8 and Android operating systems. In the second half, we will launch Bay Trail, which will further extend our product line across screen sizes and price points.

In the phone segment, we had a good first quarter in our baseband business. We are shipping LTE versions today, and are on track to ship multimode voice and data LTE baseband solutions by the end of this year. We are winning de! signs wit! h our new Clover Trail+ apps processor, where customers and third parties are highlighting both the performance and power efficiency of our architecture and are on track to ship our next-generation product, code named Merrifield, by the end of this year.

These product launches are expected to help form a second half revenue turnaround. Currently, analysts are looking for $13.75 billion in Q3 revenues. That would represent about $300 million in year over year growth, or a rise of 2.2%. Right now, it looks like Q3 will be the first quarter to show year over year revenue growth in more than a year. The last quarter of growth was Q2 of 2012.

Looking forward into Q4, the numbers are expected to be even better. The current full year revenue estimate of $53.53 billion implies Q4 revenues of about $14.30 billion. That would mean year over year growth of more than $800 million for Q4, or more than 6.1%. At that growth rate, it would be Intel's best revenue quarter in two years.

Intel will need that second half growth, and maybe a little help from Q2 as well, if it wants to avoid its second straight full year revenue decline. Current analyst estimates call for just 0.4% growth this year, a rise of about $200 million. That's not a lot of room to work with, so a slightly disappointment on Q2, or guidance for the next two quarters, could push that analyst average further to the flat line. At this point, the average for 2014 stands at $55.70 billion, which would be 4% growth on top of the 2013 figure. Intel just missed $54 billion in 2011, so they'll be looking to get above that number next year. I don't know if $54 billion would be possible in 2013 as of yet. We'd have to see a strong Q2 and above expected guidance in Q3 to make a run at it. At this point, Intel has to work on getting 2013 to be positive first, before a run at $54 billion.

Revenues first, then earnings:

Intel has also seen an earnings per share drop in recent years. After earnings per share came in at $2.39 in 2011, tha! t number ! dropped to $2.13 in 2012. That included a 10 cent benefit from the company's stock buyback program, which I'll detail more in a little while. Earnings per share are forecast to decline again in 2013, with the current analyst estimate standing at $1.87. Part of the reason was a weak first half as Intel gets their new products ready for launch. Gross margins took a huge hit in Q1, and while Q2 will be better, Q2 will still be below this year's expected figure. Here's the company's statement on gross margins for 2013 (from the Q1 call).

Gross margin of 56% was down 2 points from expectations. Increased demand from our customers allowed us to increase production of Haswell products prior to qualification for sale. The result of this was a higher than anticipated inventory writeoff, which we expect to get back throughout the rest of the year as the product is expected to qualify for sale in the second quarter.

In addition, we saw higher than expected excess capacity charges in older generation process technologies. We are taking advantage of the excess capacity on older generation process technologies to take capacity offline and reuse more equipment and space for 14 nanometer and beyond.

The results of these actions allow us to lower our capital spending forecast for the year by $1 billion, down to $12 billion. In addition, our inventories decreased almost $400 million from the fourth quarter. For the second quarter, we expect gross margin to increase 2 points to 58%, and the gross margin forecast for the year remains 60%, with gross margins in the second half back into the low 60s.

It was those inventory and excess capacity charges that really hurt in Q1, and I'll definitely be looking to see how Intel fares in Q2. If they come in in the 57.50% to 58.00% range for gross margins, I have a hard time seeing the 60% level for the full year. But if they come in closer to 58.50%, I'd be a lot more optimistic on the full year. They have been promising a big second half in terms of gross ma! rgins, an! d we will see if that forecast holds up when they report Q2 in July.

It was that huge drop in gross margins that have analysts forecasting a weak earnings per share year. In Q1, the company came in at $0.40, after a $0.53 figure in the year ago period. Current forecasts call for a 15 cent decline in Q2, followed by an 8 cent drop in Q3. As with revenues, analysts are looking for a big Q4. Current estimates imply a $0.58 number in Q4, up a dime from the 2012 period. I had been originally hoping for about $2.00 this year, but after the Q1 weakness and the buyback not providing as much boost as I thought it could, $1.90 looks more realistic now.

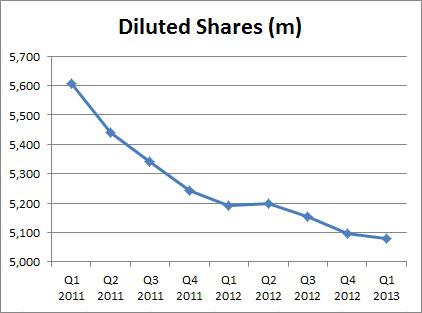

While I'm on the subject, let's discuss that buyback. Intel spent $533 million in Q1 to repurchase 25.2 million shares, an average cost of approximately $21.15. If Intel repurchases shares in Q2, which I expect that they will, it will likely be at higher prices, thanks to the stock's rally. At the end of Q1, Intel had $4.8 billion left on their current buyback, and since 1990, they have repurchased $89 billion worth of shares. Intel certainly returns a lot of capital to shareholders. The chart below shows the diluted share count over the past two years. This is not the outstanding share count, but the diluted one is used to calculate earnings per share, which is why I focus on the diluted one.

Dividend yield and growth:

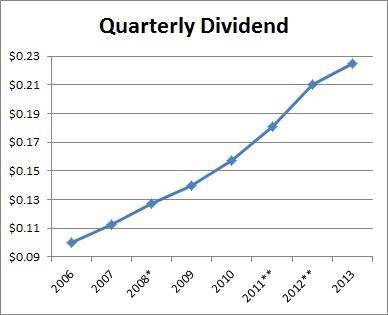

Intel has been known for its high dividend in recent years, and the chart below shows the dividend's growth since 2006. Intel has basically doubled its dividend since 2007, and yielded 3.66% as of Friday's close. That yield was much higher recently when the stock was near $20, but I think investors are satisfied with the stock's rally.

*Intel paid one q! uarterly ! dividend of $0.1275 per share to start 2008, before raising the dividend to $0.14 a quarter for the final three payments of 2008. That $0.14 was the payment for all four quarters in 2009 as well.

**Intel's first two payments in 2011 were $0.1812 a share. The company then paid $0.21 a share for the final two payments of 2011 and first two payments of 2012. The dividend was then raised to the current $0.225 for the final two payments of 2012.

With four straight payments of $0.225 per quarter, Intel investors will be waiting to hear if the next payment will be higher. It is certainly possible that Intel could raise the dividend at the next quarterly report, or maybe even before then. My prediction would be a raise to either $0.24 or $0.25 a quarter, and there is the potential that they also announce an expanded buyback too. Intel has the highest dividend yield in terms of large cap tech names, when you think of companies like Apple (AAPL), Microsoft (MSFT), Cisco Systems (CSCO), etc.

Final Thoughts - buy on pullback?

Intel has set itself up for a strong second half of the year. Multiple launches should get revenue growth going, and earnings growth will follow thereafter. Intel is still a very profitable business, and the cash flow produced supports a nice dividend and stock buyback program. The dividend could be raised in the next month or two, which could put the yield back over 4.00%. For now, Intel looks like a solid investment, and would be better if we get more of a pullback. Intel has come off about $1.50 from its recent high, and you can see from the chart below that the 50-day moving average could be the next level of support. That moving average line is moving up, and should cross the $23.50 level soon. At the moment, I'd watch Intel when we get to the 3.80% yield point, which would come at $23.68. If the 50-day is around that level, it could be a nice place to pick up shares of Intel.

(click to enlarge)

(Source: Yahoo! Finance)

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

No comments:

Post a Comment