TCF Financial (TCF) has recently released its financial results for the first quarter. The numbers were strong across the board and management raised FY18 guidance for several metrics. Despite a solid run, we still think that TCF looks attractive, especially given its outstanding revenue generation.

Back To GrowthLast November, TCF announced that it would discontinue all indirect auto loan originations. We believe it was a game-changer for the bank as its auto loan portfolio was a major concern for investors due to sub-par credit quality metrics. In addition, the exiting of the auto business should lead to a more conservative funding profile and a lower cost/income ratio. In our previous article on TCF, we also illustrated that the discontinuation of the auto would have a moderate impact on the bank's NIM.

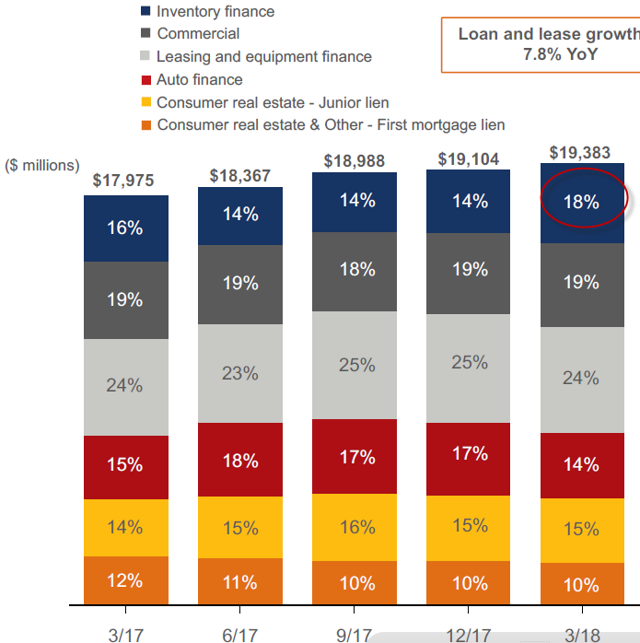

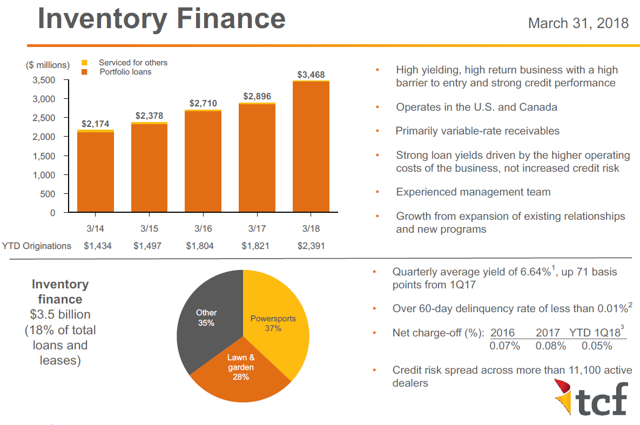

In our view, the only negative outcome from the exiting of the auto was lower loan growth, given that TCF's auto book had been growing at a double-digit rate since 2013. However, management has already done a good job of replacing auto book with inventory finance loans.

Source: Company data

Even though inventory finance growth was partly driven by seasonal factors, TCF expects it to print at 8-10% range in the second quarter. Most importantly, the growth should come organically.

Brian Maass

We've continued to add other programs in previous years as well. So I would look at the majority of that increase, a lot of that increase that happened in Q1 is seasonal. So you should see a lot of that coming down from a reduction perspective. So when you are trying to think about what the 2Q level should be, I would guide you towards looking at 2Q of last year and then think about you know some level of 8% to 10% potential higher than that.

Source

As a result, while in terms of credit growth, TCF will most likely underperform its peers, the loan origination outlook has significantly improved as inventory finance will partially offset the ongoing run-off in the auto.

Source: Company data

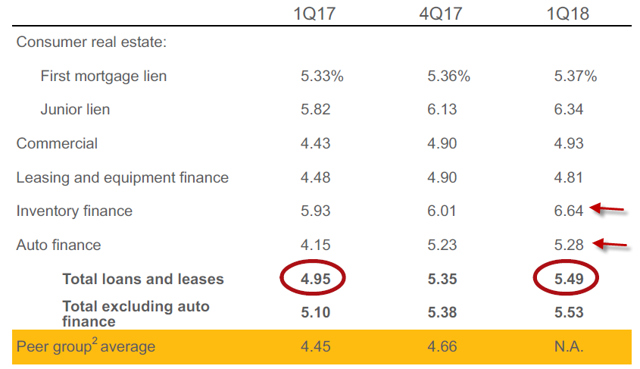

Improved Margin GuidanceOn the 1Q call, management raised its margin guidance. TCF had previously expected its NIM to decline in 2018. However, thanks to rising rates, the company now believes that the margin will stay flat or decline just by a couple of basis points in 2018.

You know I said that there would be some potential pressure on the margin over time meaning that that would build over time. However to the extent that we have interest rates going higher, you know as I said, there is a chance that those you know can offset it.

So if I was to stand back and look at, it's easier for me to kind of speak to at even on our full year guidance. Last year we were at $454 million for full year. I think there's a chance that these other offsetting factors and possibly even make it so that our net interest margin stays flat on a year-over-year basis or we'll only see a couple of basis points off on that.

Source

As noted earlier, the discontinuation of auto has had a moderate effect on the NIM. In fact, as shown below, auto finance has a lower yield compared to the group's total credit portfolio.

Source: Company data

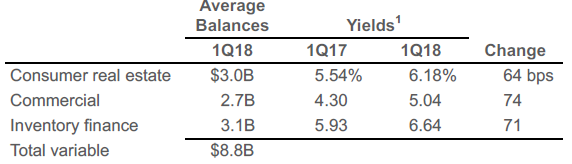

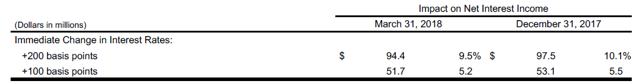

One may argue that lower inventory finance growth in the second quarter could lead to margin pressure. While it is a valid point, we note that TCF has an asset-sensitive balance sheet. In fact, it is of the biggest beneficiaries of higher rates among the US regional banks. Variable- and adjustable-rate portfolios represent 46% of the company's credit book.

Source: Company data

Moreover, around 64% of TCF's loan book is expected to re-price in the next twelve months. In other words, we believe that the ongoing re-pricing of the bank's credit portfolio will more than offset weaker loan growth.

Source: TCF 10-Q

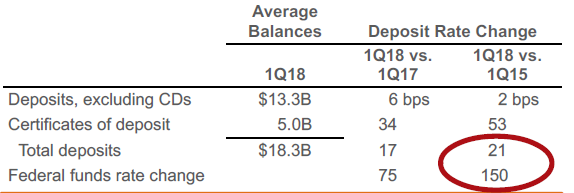

On the liabilities side, TCF enjoys a low-cost granular deposit base. Notably, 87% of the bank's deposit balances are consumer deposits. In addition, around 63% of the bank's deposits are low or no cost deposits. Thanks to such an attractive funding mix, TCF's deposit costs have increased by only 21% since the first quarter of 2015.

Source: Company data

This is a crucial competitive advantage in a rising interest rate environment.

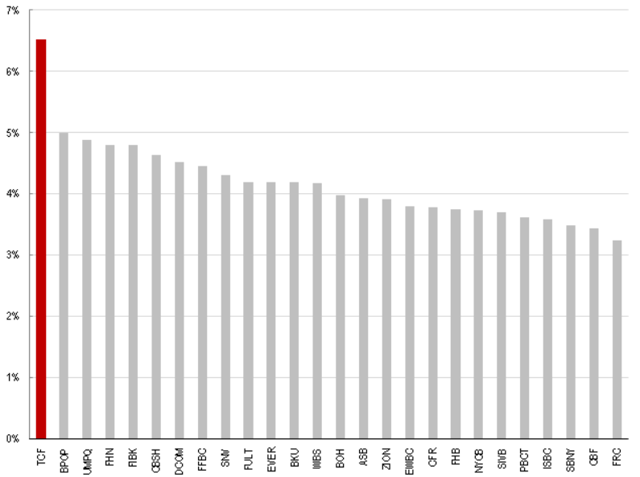

Still An Attractive M&A TargetMost importantly, we believe TCF Financial remains an attractive takeover target, given its high-quality deposit base, an asset-sensitive balance sheet, and impressive revenue generation. As we have said in our prior articles, TCF has outstanding revenue generation capability, measured as total revenues against total assets.

Source: Bloomberg, Renaissance Research

Final ThoughtsIt is also worth noting that TCF has recently increased its dividend from $0.30 to $0.60 per share. In addition, the company announced a $150mn buyback. Although the stock has had a good run, it is still reasonably valued. TCF is trading at 13x forward earnings, which we view as a very appealing multiple.

If you would like to receive our articles as soon as they are published, consider following us by clicking the "Follow" button beside our name at the top of the page. Thank you for reading.

Please note that we will provide full coverage of M&A activity in the US banking sector, including potential targets, for Banking on Financials subscribers. Sign up now to receive access to this exclusive coverage; we look forward to having you on board.

Disclosure: I am/we are long TCF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment