YHOO EBAY AMZN DELAFIELD, Wis. (Stockpickr) -- The IPO market is about to get hit with a big name that could make a real splash on Wall Street.

>>5 Stocks Set to Soar on Bullish Earnings

China-based e-commerce player Alibaba has been rumored to disclose its prospectus for an IPO in New York as soon as April. Alibaba is often called the eBay (EBAY) or Amazon.com (AMZN) of China. Some analysts think Alibaba could raise as much as $15 billion to $16 billion when it hits the public market, valuing the company at more than $100 billion.

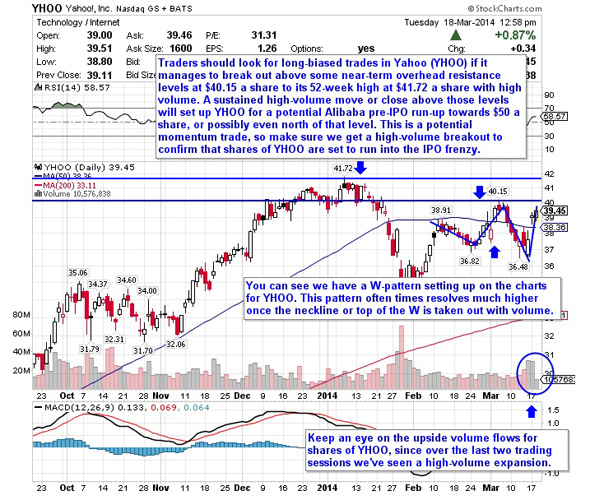

Alibaba runs an Amazon-like online shopping mall, an eBay-like platform for customers to buy from other people, a business-to-business sales platform and a PayPal-like online payment platform. Alibaba is one of the world's largest e-commerce players, and it's been rumored the company does more than $150 billion worth of sales on its online platform each year, which is more than Amazon and eBay combined. The fever for Alibaba is so high that some analysts think it could the largest IPO ever for a technology company in the U.S. Clearly, shares of Alibaba will quickly become a favorite play of the trading and investing community once it hits the U.S. exchanges. However, since we don't know the exact IPO date for Alibaba yet, traders need to find other derivative plays to capture some of the run-up momentum to the official offering date. One stock that looks to be setting up for an excellent Alibaba IPO play that could reap big rewards over the short-term is global technology player Yahoo! (YHOO). >>5 Rocket Stocks to Buy This Week The reason that Yahoo! looks so attractive here as an Alibaba IPO play is because it currently holds a 24% stake in the company. Yahoo! is required to sell a little less than half of its stake at the offering, but if that offering is a major success before and after, then Yahoo! is going to cash in big time. I believe that shares of Yahoo! are preparing right now for a momentum run-up trade into the Alibaba offering. Traders aren't going to wait for a few weeks before the offering. I think they need to start to focus on playing Yahoo! now as more and more Alibaba news stories hit the wires.  If you consult the chart for shares of Yahoo!, you'll see that this stock recently formed a double bottom chart pattern at $36.82 to $36.48 a share over the last month or so. This stock has now started to spike and gap higher back above its 50-day moving average of $38.36 a share with heavy upside volume flows. The upside volume for shares of YHOO over the last two trading sessions (not today) has registered over 29 million shares, which is well above its three-month average volume of 17.02 million shares. This unusual spike in upside volume is leading me to believe that traders are starting to snap up shares of YHOO ahead of the Alibaba IPO so they can capture some quick gains if the stock runs up into the offering. The chart for Yahoo! is also starting to form a W pattern, which is a bullish technical setup that often resolves much higher. That pattern hasn't confirmed yet, since shares of YHOO will need to break out above the neckline to give this setup a chance to really take flight, but the stock is quickly approaching that breakout which could trigger very soon. Traders should look for long-biased trades in YHOO as long as its trending above those double bottom support zones that sit just above $36 a share and then once it breaks out above some key near-term overhead resistance levels at $40.15 a share to its 52-week high at $41.72 a share with high volume. Look for volume on that breakout that hits near or above its three-month average action of 17.02 million shares. If that break kicks off soon, then I think shares of YHOO have an excellent chance to tag $50 a share, or possibly even north of that level. Keep in mind that it won't just be Alibaba pushing shares of YHOO higher if it breaks out into new 52-week-high territory -- it will also be momentum and technical traders who buy stocks showing strength off high-volume moves to new highs. If this breakout I have outlined above doesn't materialize, then of course you can forget about any run-up trade, so follow the trend with YHOO and play it only if we get a high-volume breakout conformation. -- Written by Roberto Pedone in Delafield, Wis. RELATED LINKS: >>3 Stocks Rising on Big Volume >>3 Huge Stocks on Traders' Radars >>5 Big Health Care Stocks to Trade for Gains Follow Stockpickr on Twitter and become a fan on Facebook.

If you consult the chart for shares of Yahoo!, you'll see that this stock recently formed a double bottom chart pattern at $36.82 to $36.48 a share over the last month or so. This stock has now started to spike and gap higher back above its 50-day moving average of $38.36 a share with heavy upside volume flows. The upside volume for shares of YHOO over the last two trading sessions (not today) has registered over 29 million shares, which is well above its three-month average volume of 17.02 million shares. This unusual spike in upside volume is leading me to believe that traders are starting to snap up shares of YHOO ahead of the Alibaba IPO so they can capture some quick gains if the stock runs up into the offering. The chart for Yahoo! is also starting to form a W pattern, which is a bullish technical setup that often resolves much higher. That pattern hasn't confirmed yet, since shares of YHOO will need to break out above the neckline to give this setup a chance to really take flight, but the stock is quickly approaching that breakout which could trigger very soon. Traders should look for long-biased trades in YHOO as long as its trending above those double bottom support zones that sit just above $36 a share and then once it breaks out above some key near-term overhead resistance levels at $40.15 a share to its 52-week high at $41.72 a share with high volume. Look for volume on that breakout that hits near or above its three-month average action of 17.02 million shares. If that break kicks off soon, then I think shares of YHOO have an excellent chance to tag $50 a share, or possibly even north of that level. Keep in mind that it won't just be Alibaba pushing shares of YHOO higher if it breaks out into new 52-week-high territory -- it will also be momentum and technical traders who buy stocks showing strength off high-volume moves to new highs. If this breakout I have outlined above doesn't materialize, then of course you can forget about any run-up trade, so follow the trend with YHOO and play it only if we get a high-volume breakout conformation. -- Written by Roberto Pedone in Delafield, Wis. RELATED LINKS: >>3 Stocks Rising on Big Volume >>3 Huge Stocks on Traders' Radars >>5 Big Health Care Stocks to Trade for Gains Follow Stockpickr on Twitter and become a fan on Facebook.

No comments:

Post a Comment